Form Dr 1002 - Colorado Sales/use Tax Rates

ADVERTISEMENT

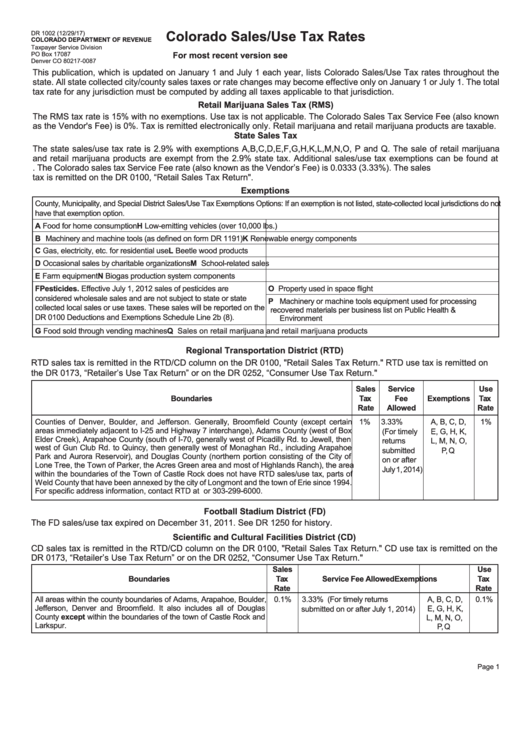

Colorado Sales/Use Tax Rates

DR 1002 (12/29/17)

COLORADO DEPARTMENT OF REVENUE

Taxpayer Service Division

For most recent version see Colorado.gov/Tax

PO Box 17087

Denver CO 80217-0087

This publication, which is updated on January 1 and July 1 each year, lists Colorado Sales/Use Tax rates throughout the

state. All state collected city/county sales taxes or rate changes may become effective only on January 1 or July 1. The total

tax rate for any jurisdiction must be computed by adding all taxes applicable to that jurisdiction.

Retail Marijuana Sales Tax (RMS)

The RMS tax rate is 15% with no exemptions. Use tax is not applicable. The Colorado Sales Tax Service Fee (also known

as the Vendor's Fee) is 0%. Tax is remitted electronically only. Retail marijuana and retail marijuana products are taxable.

State Sales Tax

The state sales/use tax rate is 2.9% with exemptions A,B,C,D,E,F,G,H,K,L,M,N,O, P and Q. The sale of retail marijuana

and retail marijuana products are exempt from the 2.9% state tax. Additional sales/use tax exemptions can be found at

Colorado.gov/Tax. The Colorado sales tax Service Fee rate (also known as the Vendor’s Fee) is 0.0333 (3.33%). The sales

tax is remitted on the DR 0100, “Retail Sales Tax Return".

Exemptions

County, Municipality, and Special District Sales/Use Tax Exemptions Options: If an exemption is not listed, state-collected local jurisdictions do not

have that exemption option.

A Food for home consumption

H Low-emitting vehicles (over 10,000 lbs.)

B Machinery and machine tools (as defined on form DR 1191)

K Renewable energy components

C Gas, electricity, etc. for residential use

L Beetle wood products

D Occasional sales by charitable organizations

M School-related sales

E Farm equipment

N Biogas production system components

F Pesticides. Effective July 1, 2012 sales of pesticides are

O Property used in space flight

considered wholesale sales and are not subject to state or state

P Machinery or machine tools equipment used for processing

collected local sales or use taxes. These sales will be reported on the

recovered materials per business list on Public Health &

DR 0100 Deductions and Exemptions Schedule Line 2b (8).

Environment

G Food sold through vending machines

Q Sales on retail marijuana and retail marijuana products

Regional Transportation District (RTD)

RTD sales tax is remitted in the RTD/CD column on the DR 0100, "Retail Sales Tax Return." RTD use tax is remitted on

the DR 0173, “Retailer’s Use Tax Return” or on the DR 0252, “Consumer Use Tax Return."

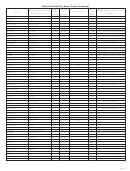

Sales

Service

Use

Boundaries

Tax

Fee

Exemptions

Tax

Rate

Allowed

Rate

Counties of Denver, Boulder, and Jefferson. Generally, Broomfield County (except certain

1%

3.33%

A, B, C, D,

1%

areas immediately adjacent to I-25 and Highway 7 interchange), Adams County (west of Box

(For timely

E, G, H, K,

Elder Creek), Arapahoe County (south of I-70, generally west of Picadilly Rd. to Jewell, then

L, M, N, O,

returns

west of Gun Club Rd. to Quincy, then generally west of Monaghan Rd., including Arapahoe

submitted

P, Q

Park and Aurora Reservoir), and Douglas County (northern portion consisting of the City of

on or after

Lone Tree, the Town of Parker, the Acres Green area and most of Highlands Ranch), the area

July 1, 2014)

within the boundaries of the Town of Castle Rock does not have RTD sales/use tax, parts of

Weld County that have been annexed by the city of Longmont and the town of Erie since 1994.

For specific address information, contact RTD at or 303-299-6000.

Football Stadium District (FD)

The FD sales/use tax expired on December 31, 2011. See DR 1250 for history.

Scientific and Cultural Facilities District (CD)

CD sales tax is remitted in the RTD/CD column on the DR 0100, "Retail Sales Tax Return." CD use tax is remitted on the

DR 0173, “Retailer’s Use Tax Return” or on the DR 0252, “Consumer Use Tax Return."

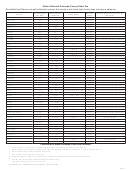

Sales

Use

Boundaries

Tax

Service Fee Allowed

Exemptions

Tax

Rate

Rate

All areas within the county boundaries of Adams, Arapahoe, Boulder,

0.1%

3.33% (For timely returns

A, B, C, D,

0.1%

Jefferson, Denver and Broomfield. It also includes all of Douglas

E, G, H, K,

submitted on or after July 1, 2014)

County except within the boundaries of the town of Castle Rock and

L, M, N, O,

Larkspur.

P, Q

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10