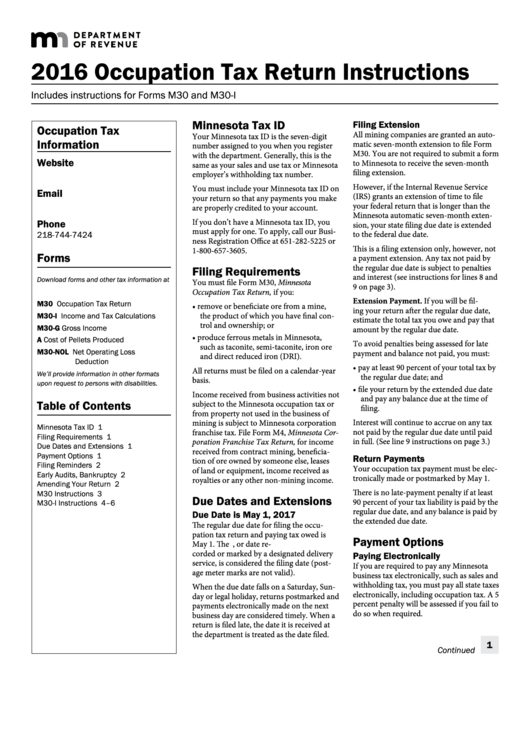

Occupation Tax Return Instructions - Minnesota Department Of Revenue - 2016

ADVERTISEMENT

2016 Occupation Tax Return Instructions

Includes instructions for Forms M30 and M30-I

Minnesota Tax ID

Filing Extension

Occupation Tax

All mining companies are granted an auto-

Your Minnesota tax ID is the seven-digit

Information

matic seven-month extension to file Form

number assigned to you when you register

M30. You are not required to submit a form

with the department. Generally, this is the

Website

to Minnesota to receive the seven-month

same as your sales and use tax or Minnesota

filing extension.

employer’s withholding tax number.

However, if the Internal Revenue Service

You must include your Minnesota tax ID on

Email

(IRS) grants an extension of time to file

your return so that any payments you make

mining.taxes@state.mn.us

your federal return that is longer than the

are properly credited to your account.

Minnesota automatic seven-month exten-

If you don’t have a Minnesota tax ID, you

Phone

sion, your state filing due date is extended

must apply for one. To apply, call our Busi-

to the federal due date.

218-744-7424

ness Registration Office at 651-282-5225 or

This is a filing extension only, however, not

1-800-657-3605.

Forms

a payment extension. Any tax not paid by

the regular due date is subject to penalties

Filing Requirements

and interest (see instructions for lines 8 and

Download forms and other tax information at

You must file Form M30, Minnesota

9 on page 3).

.

Occupation Tax Return, if you:

Extension Payment. If you will be fil-

M30

Occupation Tax Return

• remove or beneficiate ore from a mine,

ing your return after the regular due date,

the product of which you have final con-

M30-I

Income and Tax Calculations

estimate the total tax you owe and pay that

trol and ownership; or

M30-G

Gross Income

amount by the regular due date.

• produce ferrous metals in Minnesota,

A

Cost of Pellets Produced

To avoid penalties being assessed for late

such as taconite, semi-taconite, iron ore

M30-NOL Net Operating Loss

payment and balance not paid, you must:

and direct reduced iron (DRI).

Deduction

• pay at least 90 percent of your total tax by

All returns must be filed on a calendar-year

We’ll provide information in other formats

the regular due date; and

basis.

upon request to persons with disabilities.

• file your return by the extended due date

Income received from business activities not

and pay any balance due at the time of

subject to the Minnesota occupation tax or

Table of Contents

filing.

from property not used in the business of

Interest will continue to accrue on any tax

mining is subject to Minnesota corporation

Minnesota Tax ID . . . . . . . . . . . . . . . . 1

not paid by the regular due date until paid

franchise tax. File Form M4, Minnesota Cor-

Filing Requirements . . . . . . . . . . . . . . 1

in full. (See line 9 instructions on page 3.)

poration Franchise Tax Return, for income

Due Dates and Extensions . . . . . . . . 1

received from contract mining, beneficia-

Payment Options . . . . . . . . . . . . . . . . 1

Return Payments

tion of ore owned by someone else, leases

Filing Reminders . . . . . . . . . . . . . . . . 2

Your occupation tax payment must be elec-

of land or equipment, income received as

Early Audits, Bankruptcy . . . . . . . . . . 2

tronically made or postmarked by May 1.

royalties or any other non-mining income.

Amending Your Return . . . . . . . . . . . . 2

There is no late-payment penalty if at least

M30 Instructions . . . . . . . . . . . . . . . . 3

Due Dates and Extensions

90 percent of your tax liability is paid by the

M30-I Instructions . . . . . . . . . . . . . 4–6

regular due date, and any balance is paid by

Due Date is May 1, 2017

the extended due date.

The regular due date for filing the occu-

pation tax return and paying tax owed is

Payment Options

May 1. The U.S. postmark date, or date re-

corded or marked by a designated delivery

Paying Electronically

service, is considered the filing date (post-

If you are required to pay any Minnesota

age meter marks are not valid).

business tax electronically, such as sales and

withholding tax, you must pay all state taxes

When the due date falls on a Saturday, Sun-

electronically, including occupation tax. A 5

day or legal holiday, returns postmarked and

percent penalty will be assessed if you fail to

payments electronically made on the next

do so when required.

business day are considered timely. When a

return is filed late, the date it is received at

the department is treated as the date filed.

1

Continued

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6