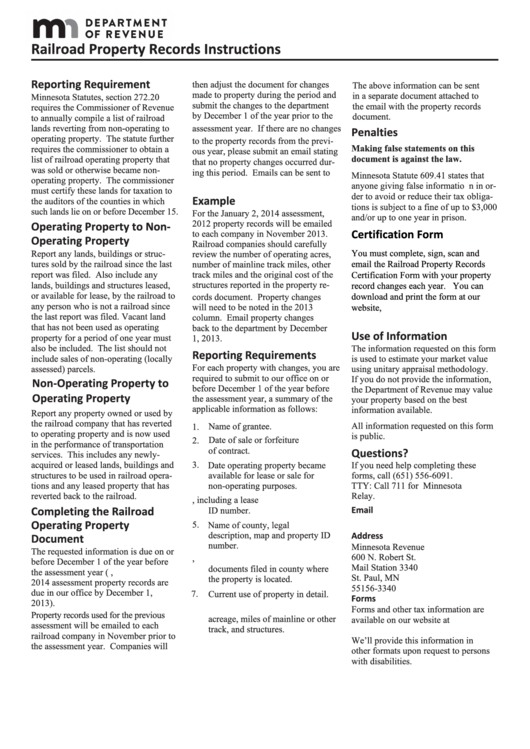

Railroad Property Records Instructions - Minnesota Department Of Revenue

ADVERTISEMENT

Railroad Property Records Instructions

Reporting Requirement

then adjust the document for changes

The above information can be sent

made to property during the period and

in a separate document attached to

Minnesota Statutes, section 272.20

submit the changes to the department

the email with the property records

requires the Commissioner of Revenue

by December 1 of the year prior to the

document.

to annually compile a list of railroad

lands reverting from non-operating to

assessment year. If there are no changes

Penalties

operating property. The statute further

to the property records from the previ-

Making false statements on this

requires the commissioner to obtain a

ous year, please submit an email stating

document is against the law.

list of railroad operating property that

that no property changes occurred dur-

was sold or otherwise became non-

ing this period. Emails can be sent to

Minnesota Statute 609.41 states that

operating property. The commissioner

sa.property@state.mn.us.

anyone giving false informatio n in or-

must certify these lands for taxation to

der to avoid or reduce their tax obliga-

Example

the auditors of the counties in which

tions is subject to a fine of up to $3,000

such lands lie on or before December 15.

For the January 2, 2014 assessment,

and/or up to one year in prison.

2012 property records will be emailed

Operating Property to Non-

Certification Form

to each company in November 2013.

Operating Property

Railroad companies should carefully

You must complete, sign, scan and

Report any lands, buildings or struc-

review the number of operating acres,

tures sold by the railroad since the last

number of mainline track miles, other

email the Railroad Property Records

track miles and the original cost of the

report was filed. Also include any

Certification Form with your property

lands, buildings and structures leased,

structures reported in the property re-

record changes each year. You can

or available for lease, by the railroad to

cords document. Property changes

download and print the form at our

any person who is not a railroad since

will need to be noted in the 2013

website,

the last report was filed. Vacant land

column. Email property changes

that has not been used as operating

back to the department by December

Use of Information

property for a period of one year must

1, 2013.

also be included. The list should not

The information requested on this form

Reporting Requirements

include sales of non-operating (locally

is used to estimate your market value

For each property with changes, you are

assessed) parcels.

using unitary appraisal methodology.

required to submit to our office on or

If you do not provide the information,

Non-Operating Property to

before December 1 of the year before

the Department of Revenue may value

Operating Property

the assessment year, a summary of the

your property based on the best

applicable information as follows:

information available.

Report any property owned or used by

the railroad company that has reverted

All information requested on this form

1. Name of grantee.

to operating property and is now used

is public.

2. Date of sale or forfeiture

in the performance of transportation

of contract.

Questions?

services. This includes any newly-

3. Date operating property became

acquired or leased lands, buildings and

If you need help completing these

structures to be used in railroad opera-

available for lease or sale for

forms, call (651) 556-6091.

TTY: Call 711 for Minnesota

tions and any leased property that has

non-operating purposes.

reverted back to the railroad.

Relay.

4. Copy of lease, including a lease

Completing the Railroad

ID number.

Email

sa.property@state.mn.us

Operating Property

5. Name of county, legal

description, map and property ID

Address

Document

number.

Minnesota Revenue

The requested information is due on or

600 N. Robert St.

6. Proof of recording sale, i.e.

before December 1 of the year before

Mail Station 3340

documents filed in county where

the assessment year (i.e. the January 2,

St. Paul, MN

the property is located.

2014 assessment property records are

55156-3340

due in our office by December 1,

7.

Current use of property in detail.

Forms

2013).

8. Changes to existing operating

Forms and other tax information are

Property records used for the previous

acreage, miles of mainline or other

available on our website at

assessment will be emailed to each

track, and structures.

railroad company in November prior to

We’ll provide this information in

the assessment year. Companies will

other formats upon request to persons

with disabilities.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1