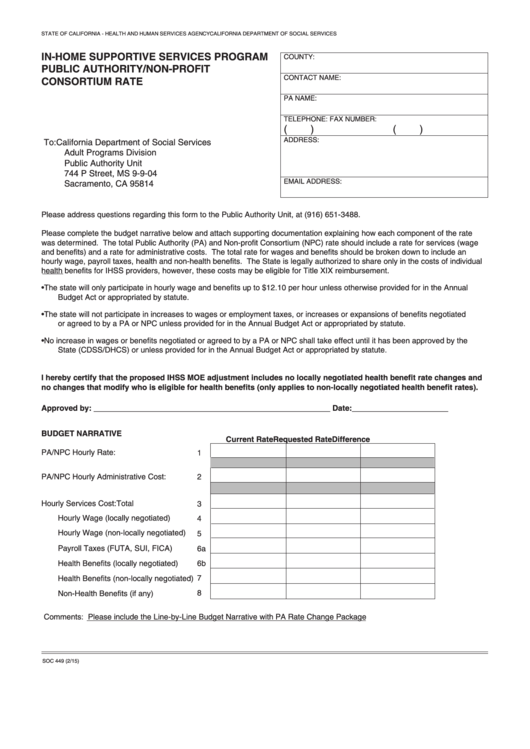

STATE OF CALIFORNIA - HEALTH AND HUMAN SERVICES AGENCY

CALIFORNIA DEPARTMENT OF SOCIAL SERVICES

IN-HOME SUPPORTIVE SERVICES PROGRAM

COUNTY:

PUBLIC AUTHORITY/NON-PROFIT

CONTACT NAME:

CONSORTIUM RATE

PA NAME:

TELEPHONE:

FAX NUMBER:

(

)

(

)

ADDRESS:

To: California Department of Social Services

Adult Programs Division

Public Authority Unit

744 P Street, MS 9-9-04

EMAIL ADDRESS:

Sacramento, CA 95814

Please address questions regarding this form to the Public Authority Unit, at (916) 651-3488.

Please complete the budget narrative below and attach supporting documentation explaining how each component of the rate

was determined. The total Public Authority (PA) and Non-profit Consortium (NPC) rate should include a rate for services (wage

and benefits) and a rate for administrative costs. The total rate for wages and benefits should be broken down to include an

hourly wage, payroll taxes, health and non-health benefits. The State is legally authorized to share only in the costs of individual

health benefits for IHSS providers, however, these costs may be eligible for Title XIX reimbursement.

•

The state will only participate in hourly wage and benefits up to $12.10 per hour unless otherwise provided for in the Annual

Budget Act or appropriated by statute.

•

The state will not participate in increases to wages or employment taxes, or increases or expansions of benefits negotiated

or agreed to by a PA or NPC unless provided for in the Annual Budget Act or appropriated by statute.

•

No increase in wages or benefits negotiated or agreed to by a PA or NPC shall take effect until it has been approved by the

State (CDSS/DHCS) or unless provided for in the Annual Budget Act or appropriated by statute.

I hereby certify that the proposed IHSS MOE adjustment includes no locally negotiated health benefit rate changes and

no changes that modify who is eligible for health benefits (only applies to non-locally negotiated health benefit rates).

Approved by: ______________________________________________________ Date:______________________

BUDGET NARRATIVE

Current Rate

Requested Rate

Difference

PA/NPC Hourly Rate:

1

PA/NPC Hourly Administrative Cost:

2

Hourly Services Cost:

Total

3

Hourly Wage (locally negotiated)

4

Hourly Wage (non-locally negotiated)

5

Payroll Taxes (FUTA, SUI, FICA)

6a

Health Benefits (locally negotiated)

6b

7

Health Benefits (non-locally negotiated)

8

Non-Health Benefits (if any)

Comments: Please include the Line-by-Line Budget Narrative with PA Rate Change Package

SOC 449 (2/15)

1

1