Instructions For Form Ub-106-A-Ff - Instructions For Completing Weekly Claim For Ui Benefits

ADVERTISEMENT

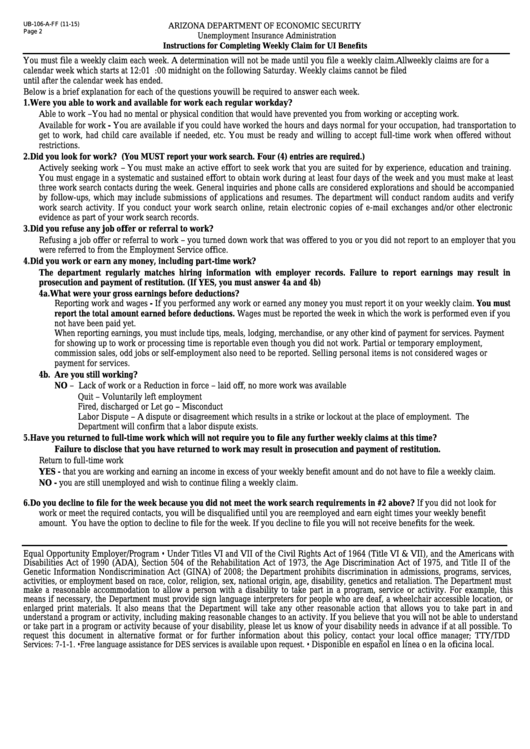

UB-106-A-FF (11-15)

ARIZONA DEPARTMENT OF ECONOMIC SECURITY

Page 2

Unemployment Insurance Administration

Instructions for Completing Weekly Claim for UI Benefits

You must file a weekly claim each week. A determination will not be made until you file a weekly claim. All weekly claims are for a

calendar week which starts at 12:01 a.m. Sunday and ends at 12:00 midnight on the following Saturday. Weekly claims cannot be filed

until after the calendar week has ended.

Below is a brief explanation for each of the questions you will be required to answer each week.

1.

Were you able to work and available for work each regular workday?

Able to work – You had no mental or physical condition that would have prevented you from working or accepting work.

Available for work - You are available if you could have worked the hours and days normal for your occupation, had transportation to

get to work, had child care available if needed, etc. You must be ready and willing to accept full-time work when offered without

restrictions.

2.

Did you look for work? (You MUST report your work search. Four (4) entries are required.)

Actively seeking work – You must make an active effort to seek work that you are suited for by experience, education and training.

You must engage in a systematic and sustained effort to obtain work during at least four days of the week and you must make at least

three work search contacts during the week. General inquiries and phone calls are considered explorations and should be accompanied

by follow-ups, which may include submissions of applications and resumes. The department will conduct random audits and verify

work search activity. If you conduct your work search online, retain electronic copies of e-mail exchanges and/or other electronic

evidence as part of your work search records.

3.

Did you refuse any job offer or referral to work?

Refusing a job offer or referral to work – you turned down work that was offered to you or you did not report to an employer that you

were referred to from the Employment Service office.

4.

Did you work or earn any money, including part-time work?

The department regularly matches hiring information with employer records. Failure to report earnings may result in

prosecution and payment of restitution. (If YES, you must answer 4a and 4b)

4a. What were your gross earnings before deductions?

Reporting work and wages - If you performed any work or earned any money you must report it on your weekly claim. You must

report the total amount earned before deductions. Wages must be reported the week in which the work is performed even if you

not have been paid yet.

When reporting earnings, you must include tips, meals, lodging, merchandise, or any other kind of payment for services. Payment

for showing up to work or processing time is reportable even though you did not work. Partial or temporary employment,

commission sales, odd jobs or self-employment also need to be reported. Selling personal items is not considered wages or

payment for services.

4b. Are you still working?

NO – Lack of work or a Reduction in force – laid off, no more work was available

Quit – Voluntarily left employment

Fired, discharged or Let go – Misconduct

Labor Dispute – A dispute or disagreement which results in a strike or lockout at the place of employment. The

Department will confirm that a labor dispute exists.

5.

Have you returned to full-time work which will not require you to file any further weekly claims at this time?

Failure to disclose that you have returned to work may result in prosecution and payment of restitution.

Return to full-time work

YES - that you are working and earning an income in excess of your weekly benefit amount and do not have to file a weekly claim.

NO - you are still unemployed and wish to continue filing a weekly claim.

6.

Do you decline to file for the week because you did not meet the work search requirements in #2 above? If you did not look for

work or meet the required contacts, you will be disqualified until you are reemployed and earn eight times your weekly benefit

amount. You have the option to decline to file for the week. If you decline to file you will not receive benefits for the week.

Equal Opportunity Employer/Program • Under Titles VI and VII of the Civil Rights Act of 1964 (Title VI & VII), and the Americans with

Disabilities Act of 1990 (ADA), Section 504 of the Rehabilitation Act of 1973, the Age Discrimination Act of 1975, and Title II of the

Genetic Information Nondiscrimination Act (GINA) of 2008; the Department prohibits discrimination in admissions, programs, services,

activities, or employment based on race, color, religion, sex, national origin, age, disability, genetics and retaliation. The Department must

make a reasonable accommodation to allow a person with a disability to take part in a program, service or activity. For example, this

means if necessary, the Department must provide sign language interpreters for people who are deaf, a wheelchair accessible location, or

enlarged print materials. It also means that the Department will take any other reasonable action that allows you to take part in and

understand a program or activity, including making reasonable changes to an activity. If you believe that you will not be able to understand

or take part in a program or activity because of your disability, please let us know of your disability needs in advance if at all possible. To

request this document in alternative format or for further information about this policy, contact your local office manager; TTY/TDD

Services: 7-1-1. • Free language assistance for DES services is available upon request. •

Disponible en español en línea o en la oficina local.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2