STATE OF CALIFORNIA - HEALTH AND HUMAN SERVICES AGENCY

CALIFORNIA DEPARTMENT OF SOCIAL SERVICES

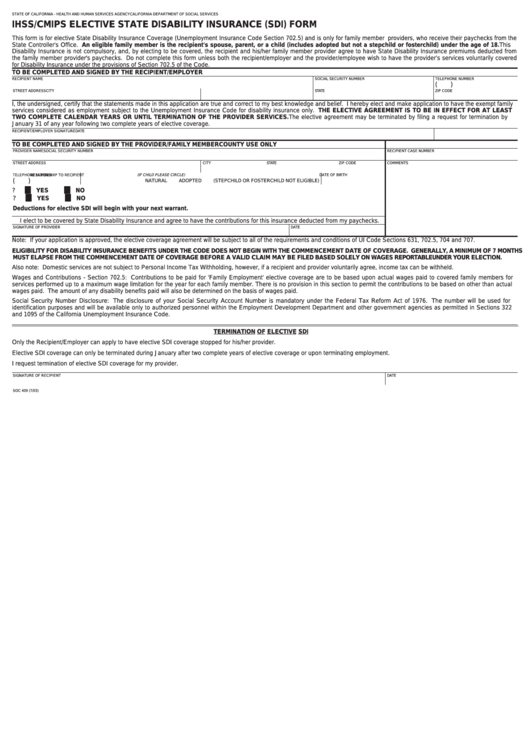

IHSS/CMIPS ELECTIVE STATE DISABILITY INSURANCE (SDI) FORM

This form is for elective State Disability Insurance Coverage (Unemployment Insurance Code Section 702.5) and is only for family member providers, who receive their paychecks from the

State Controller's Office. An eligible family member is the recipient's spouse, parent, or a child (includes adopted but not a stepchild or fosterchild) under the age of 18. This

Disability Insurance is not compulsory, and, by electing to be covered, the recipient and his/her family member provider agree to have State Disability Insurance premiums deducted from

the family member provider's paychecks. Do not complete this form unless both the recipient/employer and the provider/employee wish to have the provider’s services voluntarily covered

for Disability Insurance under the provisions of Section 702.5 of the Code.

TO BE COMPLETED AND SIGNED BY THE RECIPIENT/EMPLOYER

RECIPIENT NAME

SOCIAL SECURITY NUMBER

TELEPHONE NUMBER

(

)

STREET ADDRESS

CITY

STATE

ZIP CODE

I, the undersigned, certify that the statements made in this application are true and correct to my best knowledge and belief. I hereby elect and make application to have the exempt family

services considered as employment subject to the Unemployment Insurance Code for disability insurance only. THE ELECTIVE AGREEMENT IS TO BE IN EFFECT FOR AT LEAST

TWO COMPLETE CALENDAR YEARS OR UNTIL TERMINATION OF THE PROVIDER SERVICES. The elective agreement may be terminated by filing a request for termination by

January 31 of any year following two complete years of elective coverage.

RECIPIENT/EMPLOYER SIGNATURE

DATE

TO BE COMPLETED AND SIGNED BY THE PROVIDER/FAMILY MEMBER

COUNTY USE ONLY

PROVIDER NAME

SOCIAL SECURITY NUMBER

RECIPIENT CASE NUMBER

STREET ADDRESS

CITY

STATE

ZIP CODE

COMMENTS

TELEPHONE NUMBER

RELATIONSHIP TO RECIPIENT (IF CHILD PLEASE CIRCLE)

DATE OF BIRTH

(

)

NATURAL

ADOPTED

(STEPCHILD OR FOSTERCHILD NOT ELIGIBLE)

1.

Is the employment intended to be continuing and not intermittent or seasonal in nature? ......................................

YES

NO

2.

Are you able to perform normal and customary provider services with IHSS?........................................................

YES

NO

Deductions for elective SDI will begin with your next warrant.

I elect to be covered by State Disability Insurance and agree to have the contributions for this insurance deducted from my paychecks.

SIGNATURE OF PROVIDER

DATE

Note: If your application is approved, the elective coverage agreement will be subject to all of the requirements and conditions of UI Code Sections 631, 702.5, 704 and 707.

ELIGIBILITY FOR DISABILITY INSURANCE BENEFITS UNDER THE CODE DOES NOT BEGIN WITH THE COMMENCEMENT DATE OF COVERAGE. GENERALLY, A MINIMUM OF 7 MONTHS

MUST ELAPSE FROM THE COMMENCEMENT DATE OF COVERAGE BEFORE A VALID CLAIM MAY BE FILED BASED SOLELY ON WAGES REPORTABLE UNDER YOUR ELECTION.

Also note: Domestic services are not subject to Personal Income Tax Withholding, however, if a recipient and provider voluntarily agree, income tax can be withheld.

Wages and Contributions - Section 702.5: Contributions to be paid for 'Family Employment' elective coverage are to be based upon actual wages paid to covered family members for

services performed up to a maximum wage limitation for the year for each family member. There is no provision in this section to permit the contributions to be based on other than actual

wages paid. The amount of any disability benefits paid will also be determined on the basis of wages paid.

Social Security Number Disclosure: The disclosure of your Social Security Account Number is mandatory under the Federal Tax Reform Act of 1976. The number will be used for

identification purposes and will be available only to authorized personnel within the Employment Development Department and other government agencies as permitted in Sections 322

and 1095 of the California Unemployment Insurance Code.

TERMINATION OF ELECTIVE SDI

Only the Recipient/Employer can apply to have elective SDI coverage stopped for his/her provider.

Elective SDI coverage can only be terminated during January after two complete years of elective coverage or upon terminating employment.

I request termination of elective SDI coverage for my provider.

SIGNATURE OF RECIPIENT

DATE

SOC 409 (7/03)

1

1