Instructions For Form M706 - Estate Tax - Minnesota Department Of Revenue - 2016

ADVERTISEMENT

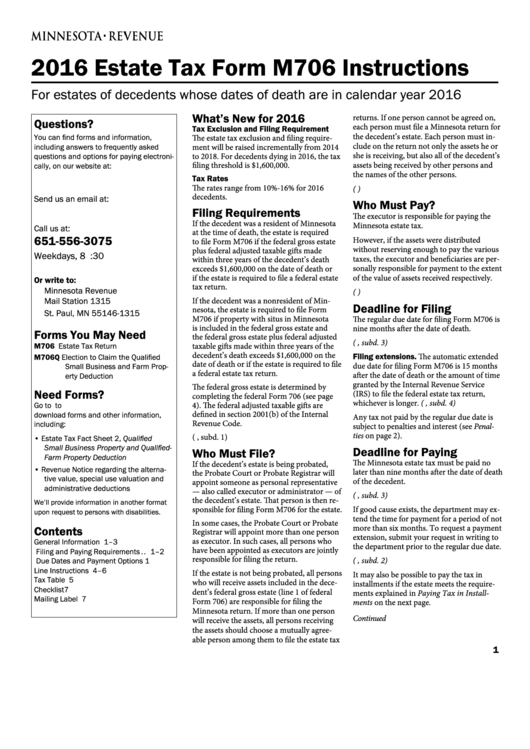

2016 Estate Tax Form M706 Instructions

For estates of decedents whose dates of death are in calendar year 2016

What’s New for 2016

returns. If one person cannot be agreed on,

Questions?

each person must file a Minnesota return for

Tax Exclusion and Filing Requirement

the decedent’s estate. Each person must in-

You can find forms and information,

The estate tax exclusion and filing require-

clude on the return not only the assets he or

ment will be raised incrementally from 2014

including answers to frequently asked

she is receiving, but also all of the decedent’s

to 2018. For decedents dying in 2016, the tax

questions and options for paying electroni-

filing threshold is $1,600,000.

assets being received by other persons and

cally, on our website at:

the names of the other persons.

Tax Rates

The rates range from 10%-16% for 2016

(M.S. 289A.10 and M.S. 291.12)

decedents.

Send us an email at:

Who Must Pay?

Filing Requirements

BusinessIncome.tax@state.mn.us

The executor is responsible for paying the

If the decedent was a resident of Minnesota

Minnesota estate tax.

Call us at:

at the time of death, the estate is required

651-556-3075

However, if the assets were distributed

to file Form M706 if the federal gross estate

without reserving enough to pay the various

plus federal adjusted taxable gifts made

Weekdays, 8 a.m. to 4:30 p.m.

taxes, the executor and beneficiaries are per-

within three years of the decedent’s death

sonally responsible for payment to the extent

exceeds $1,600,000 on the date of death or

if the estate is required to file a federal estate

of the value of assets received respectively.

Or write to:

tax return.

Minnesota Revenue

(M.S. 270C.585 and M.S. 291.12)

If the decedent was a nonresident of Min-

Mail Station 1315

Deadline for Filing

nesota, the estate is required to file Form

St. Paul, MN 55146-1315

M706 if property with situs in Minnesota

The regular due date for filing Form M706 is

is included in the federal gross estate and

nine months after the date of death.

Forms You May Need

the federal gross estate plus federal adjusted

(M.S. 289A.18, subd. 3)

taxable gifts made within three years of the

M706

Estate Tax Return

decedent’s death exceeds $1,600,000 on the

Filing extensions. The automatic extended

M706Q Election to Claim the Qualified

date of death or if the estate is required to file

due date for filing Form M706 is 15 months

Small Business and Farm Prop-

a federal estate tax return.

after the date of death or the amount of time

erty Deduction

granted by the Internal Revenue Service

The federal gross estate is determined by

Need Forms?

(IRS) to file the federal estate tax return,

completing the federal Form 706 (see page

whichever is longer. (M.S. 289A.19, subd. 4)

4). The federal adjusted taxable gifts are

Go to to

defined in section 2001(b) of the Internal

download forms and other information,

Any tax not paid by the regular due date is

Revenue Code.

including:

subject to penalties and interest (see Penal-

ties on page 2).

(M.S. 289A.10, subd. 1)

• Estate Tax Fact Sheet 2, Qualified

Small Business Property and Qualified-

Deadline for Paying

Who Must File?

Farm Property Deduction

The Minnesota estate tax must be paid no

If the decedent’s estate is being probated,

• Revenue Notice regarding the alterna-

later than nine months after the date of death

the Probate Court or Probate Registrar will

tive value, special use valuation and

of the decedent.

appoint someone as personal representative

administrative deductions

— also called executor or administrator — of

(M.S. 289A.20, subd. 3)

the decedent’s estate. That person is then re-

We’ll provide information in another format

sponsible for filing Form M706 for the estate.

If good cause exists, the department may ex-

upon request to persons with disabilities.

tend the time for payment for a period of not

In some cases, the Probate Court or Probate

more than six months. To request a payment

Contents

Registrar will appoint more than one person

extension, submit your request in writing to

as executor. In such cases, all persons who

General Information . . . . . . . . . . . . . 1–3

the department prior to the regular due date.

have been appointed as executors are jointly

Filing and Paying Requirements . . 1–2

responsible for filing the return.

(M.S. 289A.30, subd. 2)

Due Dates and Payment Options . . . . 1

Line Instructions . . . . . . . . . . . . . . . . 4–6

If the estate is not being probated, all persons

It may also be possible to pay the tax in

Tax Table . . . . . . . . . . . . . . . . . . . . . . . . . 5

who will receive assets included in the dece-

installments if the estate meets the require-

Checklist . . . . . . . . . . . . . . . . . . . . . . . . . 7

dent’s federal gross estate (line 1 of federal

ments explained in Paying Tax in Install-

Mailing Label . . . . . . . . . . . . . . . . . . . . . 7

Form 706) are responsible for filing the

ments on the next page.

Minnesota return. If more than one person

Continued

will receive the assets, all persons receiving

the assets should choose a mutually agree-

able person among them to file the estate tax

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7