Hospital And Surgical Center Taxes - Minnesota Department Of Revenue

ADVERTISEMENT

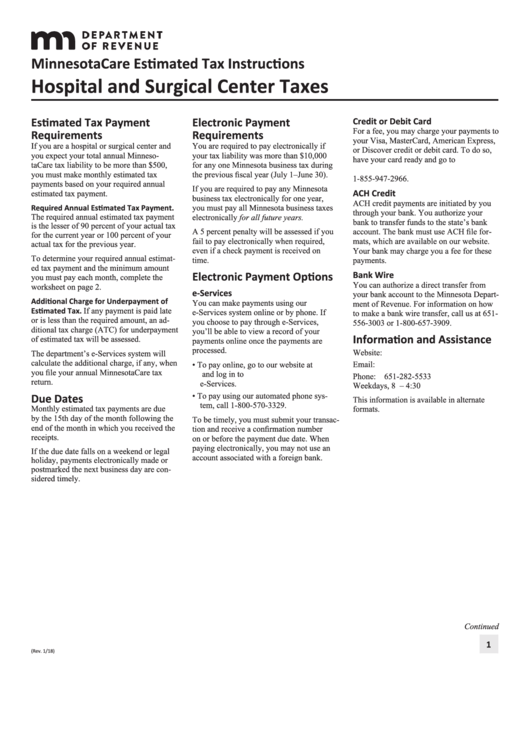

MinnesotaCare Estimated Tax Instructions

Hospital and Surgical Center Taxes

Estimated Tax Payment

Electronic Payment

Credit or Debit Card

For a fee, you may charge your payments to

Requirements

Requirements

your Visa, MasterCard, American Express,

If you are a hospital or surgical center and

You are required to pay electronically if

or Discover credit or debit card. To do so,

you expect your total annual Minneso-

your tax liability was more than $10,000

have your card ready and go to

taCare tax liability to be more than $500,

for any one Minnesota business tax during

or call

you must make monthly estimated tax

the previous fiscal year (July 1–June 30).

1-855-947-2966.

payments based on your required annual

If you are required to pay any Minnesota

ACH Credit

estimated tax payment.

business tax electronically for one year,

ACH credit payments are initiated by you

you must pay all Minnesota business taxes

Required Annual Estimated Tax Payment.

through your bank. You authorize your

The required annual estimated tax payment

electronically for all future years.

bank to transfer funds to the state’s bank

is the lesser of 90 percent of your actual tax

A 5 percent penalty will be assessed if you

account. The bank must use ACH file for-

for the current year or 100 percent of your

fail to pay electronically when required,

mats, which are available on our website.

actual tax for the previous year.

even if a check payment is received on

Your bank may charge you a fee for these

To determine your required annual estimat-

time.

payments.

ed tax payment and the minimum amount

Electronic Payment Options

Bank Wire

you must pay each month, complete the

You can authorize a direct transfer from

worksheet on page 2.

e-Services

your bank account to the Minnesota Depart-

Additional Charge for Underpayment of

You can make payments using our

ment of Revenue. For information on how

Estimated Tax. If any payment is paid late

e-Services system online or by phone. If

to make a bank wire transfer, call us at 651-

or is less than the required amount, an ad-

you choose to pay through e-Services,

556-3003 or 1-800-657-3909.

ditional tax charge (ATC) for underpayment

you’ll be able to view a record of your

Information and Assistance

of estimated tax will be assessed.

payments online once the payments are

processed.

Website:

The department’s e-Services system will

calculate the additional charge, if any, when

• To pay online, go to our website at

Email:

MinnesotaCare.tax@state.mn.us

you file your annual MinnesotaCare tax

and log in to

Phone: 651-282-5533

return.

e-Services.

Weekdays, 8 a.m. – 4:30 p.m.

• To pay using our automated phone sys-

Due Dates

This information is available in alternate

tem, call 1-800-570-3329.

Monthly estimated tax payments are due

formats.

by the 15th day of the month following the

To be timely, you must submit your transac-

end of the month in which you received the

tion and receive a confirmation number

receipts.

on or before the payment due date. When

paying electronically, you may not use an

If the due date falls on a weekend or legal

account associated with a foreign bank.

holiday, payments electronically made or

postmarked the next business day are con-

sidered timely.

Continued

1

(Rev. 1/18)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2