Minnesota Unrelated Business Income Tax (Ubit) Instructions - Minnesota Department Of Revenue - 2017

ADVERTISEMENT

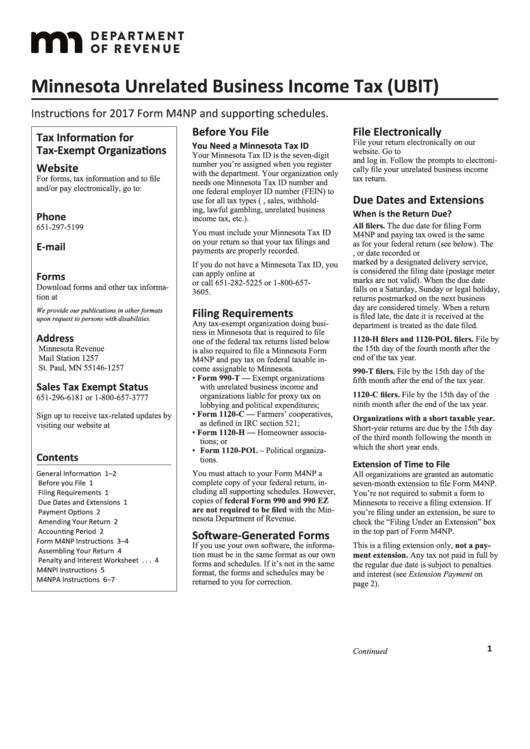

Minnesota Unrelated Business Income Tax (UBIT)

Instructions for 2017 Form M4NP and supporting schedules.

Before You File

File Electronically

Tax Information for

File your return electronically on our

You Need a Minnesota Tax ID

Tax-Exempt Organizations

website. Go to

Your Minnesota Tax ID is the seven-digit

and log in. Follow the prompts to electroni-

number you’re assigned when you register

Website

cally file your unrelated business income

with the department. Your organization only

For forms, tax information and to file

tax return.

needs one Minnesota Tax ID number and

and/or pay electronically, go to:

one federal employer ID number (FEIN) to

Due Dates and Extensions

use for all tax types (e.g., sales, withhold-

ing, lawful gambling, unrelated business

When is the Return Due?

Phone

income tax, etc.).

All filers. The due date for filing Form

651-297-5199

You must include your Minnesota Tax ID

M4NP and paying tax owed is the same

on your return so that your tax filings and

as for your federal return (see below). The

E-mail

payments are properly recorded.

U.S. postmark date, or date recorded or

ubi.taxes@state.mn.us

marked by a designated delivery service,

If you do not have a Minnesota Tax ID, you

is considered the filing date (postage meter

can apply online at

Forms

marks are not valid). When the due date

mn.us or call 651-282-5225 or 1-800-657-

Download forms and other tax informa-

falls on a Saturday, Sunday or legal holiday,

3605.

tion at .

returns postmarked on the next business

day are considered timely. When a return

We provide our publications in other formats

Filing Requirements

is filed late, the date it is received at the

upon request to persons with disabilities.

Any tax-exempt organization doing busi-

department is treated as the date filed.

ness in Minnesota that is required to file

Address

1120-H filers and 1120-POL filers. File by

one of the federal tax returns listed below

Minnesota Revenue

the 15th day of the fourth month after the

is also required to file a Minnesota Form

end of the tax year.

Mail Station 1257

M4NP and pay tax on federal taxable in-

St. Paul, MN 55146-1257

come assignable to Minnesota.

990-T filers. File by the 15th day of the

• Form 990-T — Exempt organizations

fifth month after the end of the tax year.

Sales Tax Exempt Status

with unrelated business income and

1120-C filers. File by the 15th day of the

organizations liable for proxy tax on

651-296-6181 or 1-800-657-3777

ninth month after the end of the tax year.

lobbying and political expenditures;

• Form 1120-C — Farmers’ cooperatives,

Sign up to receive tax-related updates by

Organizations with a short taxable year.

as defined in IRC section 521;

visiting our website at

Short-year returns are due by the 15th day

• Form 1120-H — Homeowner associa-

state.mn.us

of the third month following the month in

tions; or

which the short year ends.

• Form 1120-POL – Political organiza-

Contents

tions.

Extension of Time to File

You must attach to your Form M4NP a

General Information . . . . . . . . . . . . . 1–2

All organizations are granted an automatic

complete copy of your federal return, in-

Before you File . . . . . . . . . . . . . . . . . 1

seven-month extension to file Form M4NP.

cluding all supporting schedules. However,

Filing Requirements . . . . . . . . . . . . . 1

You’re not required to submit a form to

copies of federal Form 990 and 990 EZ

Minnesota to receive a filing extension. If

Due Dates and Extensions . . . . . . . . 1

are not required to be filed with the Min-

you’re filing under an extension, be sure to

Payment Options . . . . . . . . . . . . . . . 2

nesota Department of Revenue.

check the “Filing Under an Extension” box

Amending Your Return . . . . . . . . . . . 2

in the top part of Form M4NP.

Accounting Period . . . . . . . . . . . . . . 2

Software-Generated Forms

Form M4NP Instructions . . . . . . . . . . 3–4

If you use your own software, the informa-

This is a filing extension only, not a pay-

Assembling Your Return . . . . . . . . . . 4

tion must be in the same format as our own

ment extension. Any tax not paid in full by

Penalty and Interest Worksheet . . . 4

forms and schedules. If it’s not in the same

the regular due date is subject to penalties

M4NPI Instructions . . . . . . . . . . . . . . . . 5

format, the forms and schedules may be

and interest (see Extension Payment on

M4NPA Instructions . . . . . . . . . . . . . . 6–7

returned to you for correction.

page 2).

1

Continued

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7