Form W-9 - State Of Arizona Substitute W-9 Form Request For Taxpayer Identification And Certification

ADVERTISEMENT

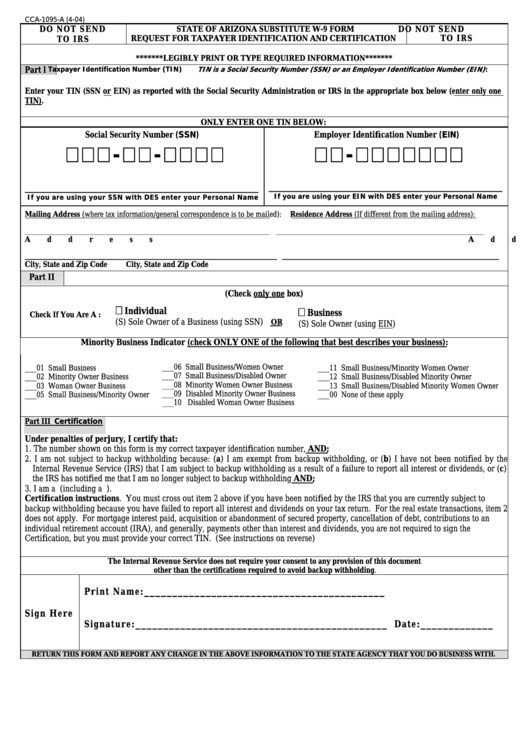

CCA-1095-A (4-04)

DO NO T SEND

STATE OF ARIZONA SUBSTITUTE W-9 FORM

DO NO T SEND

REQUEST FOR TAXPAYER IDENTIFICATION AND CERTIFICATION

TO I RS

TO I RS

*******LEGIBLY PRINT OR TYPE REQUIRED INFORMATION*******

TIN is a Social Security Number (SSN) or an Employer Identification Number (EIN)

Taxpayer Identification Number (TIN)

:

Part l

Enter your TIN (SSN or EIN) as reported with the Social Security Administration or IRS in the appropriate box below (enter only one

TIN).

ONLY ENTER ONE TIN BELOW:

Social Security Number (SSN)

Employer Identification Number (EIN)

-

-

-

____________________________________________________________

____________________________________________________________

If you are using your EIN with DES enter your Personal Name

If you are using your SSN with DES enter your Personal Name

Mailing Address (where tax information/general correspondence is to be mailed):

Residence Address (If different from the mailing address):

_________________________________________________________________________________

_____________________________________________________________________

Address

Address

_______________________________________________________________________

_____________________________________________________________

City, State and Zip Code

City, State and Zip Code

Part II

(Check only one box)

Individual

Business

Check If You Are A :

(S) Sole Owner of a Business (using SSN)

OR

(S) Sole Owner (using EIN)

Minority Business Indicator (check ONLY ONE of the following that best describes your business):

___06 Small Business/Women Owner

___01 Small Business

___11 Small Business/Minority Women Owner

___07 Small Business/Disabled Owner

___02 Minority Owner Business

___12 Small Business/Disabled Minority Owner

___08 Minority Women Owner Business

___03 Woman Owner Business

___13 Small Business/Disabled Minority Women Owner

___09 Disabled Minority Owner Business

___05 Small Business/Minority Owner

___00 None of these apply

___10 Disabled Woman Owner Business

Part III Certification

Under penalties of perjury, I certify that:

1. The number shown on this form is my correct taxpayer identification number, AND;

2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the

Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c)

the IRS has notified me that I am no longer subject to backup withholding AND;

3. I am a U.S. person (including a U.S. resident alien).

Certification instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to

backup withholding because you have failed to report all interest and dividends on your tax return. For the real estate transactions, item 2

does not apply. For mortgage interest paid, acquisition or abandonment of secured property, cancellation of debt, contributions to an

individual retirement account (IRA), and generally, payments other than interest and dividends, you are not required to sign the

Certification, but you must provide your correct TIN. (See instructions on reverse)

The Internal Revenue Service does not require your consent to any provision of this document

other than the certifications required to avoid backup withholding.

Print Name:___________________________________________

Sign Here

Signature:_____________________________________________ Date:_____________

RETURN THIS FORM AND REPORT ANY CHANGE IN THE ABOVE INFORMATION TO THE STATE AGENCY THAT YOU DO BUSINESS WITH.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2