STATE OF CALIFORNIA - HEALTH AND HUMAN SERVICES AGENCY

CALIFORNIA DEPARTMENT OF SOCIAL SERVICES

DATE ISSUED:

REPORTING CHANGES FOR CASH AID

CASE NAME:

AND CALFRESH

CASE NUMBER:

WORKER NUMBER:

Penalty for not reporting

Because you get

Cash Aid

CalFresh, you must

report within 10 days when your TOTAL income reaches

If you do not report when your income is more than your

a certain level. You must report anytime your household’s

household’s IRT limit you might get more benefits than you

total monthly income is more than your current Income

should. You must repay any extra benefits you get. If you

Reporting Threshold (IRT).

do not report on purpose to try to get more benefits, this is

fraud, and you may be charged with a crime and/or may

no longer get CalFresh for a period of time or life.

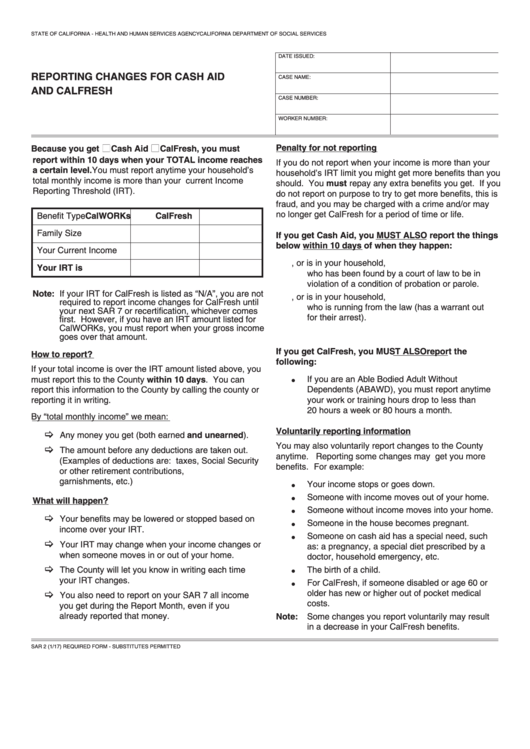

Benefit Type

CalWORKs

CalFresh

Family Size

If you get Cash Aid, you MUST ALSO report the things

below within 10 days of when they happen:

Your Current Income

1. Anytime someone joins, or is in your household,

Your IRT is

who has been found by a court of law to be in

violation of a condition of probation or parole.

Note: If your IRT for CalFresh is listed as “N/A”, you are not

2. Anytime someone joins, or is in your household,

required to report income changes for CalFresh until

who is running from the law (has a warrant out

your next SAR 7 or recertification, whichever comes

for their arrest).

first. However, if you have an IRT amount listed for

CalWORKs, you must report when your gross income

3. Anytime you have an address change.

goes over that amount.

If you get CalFresh, you MUST ALSO report the

How to report?

following:

If your total income is over the IRT amount listed above, you

must report this to the County within 10 days. You can

If you are an Able Bodied Adult Without

G

Dependents (ABAWD), you must report anytime

report this information to the County by calling the county or

your work or training hours drop to less than

reporting it in writing.

20 hours a week or 80 hours a month.

By “total monthly income” we mean:

Voluntarily reporting information

Any money you get (both earned and unearned).

You may also voluntarily report changes to the County

The amount before any deductions are taken out.

anytime. Reporting some changes may get you more

(Examples of deductions are: taxes, Social Security

benefits. For example:

or other retirement contributions,

garnishments, etc.)

Your income stops or goes down.

G

Someone with income moves out of your home.

What will happen?

G

Someone without income moves into your home.

G

Your benefits may be lowered or stopped based on

Someone in the house becomes pregnant.

G

income over your IRT.

Someone on cash aid has a special need, such

G

Your IRT may change when your income changes or

as: a pregnancy, a special diet prescribed by a

when someone moves in or out of your home.

doctor, household emergency, etc.

The County will let you know in writing each time

The birth of a child.

G

your IRT changes.

For CalFresh, if someone disabled or age 60 or

G

older has new or higher out of pocket medical

You also need to report on your SAR 7 all income

costs.

you get during the Report Month, even if you

already reported that money.

Note: Some changes you report voluntarily may result

in a decrease in your CalFresh benefits.

SAR 2 (1/17) REQUIRED FORM - SUBSTITUTES PERMITTED

1

1