Form Cd-310v - Electric And Piped Natural Gas Monthly Tax Remittance

ADVERTISEMENT

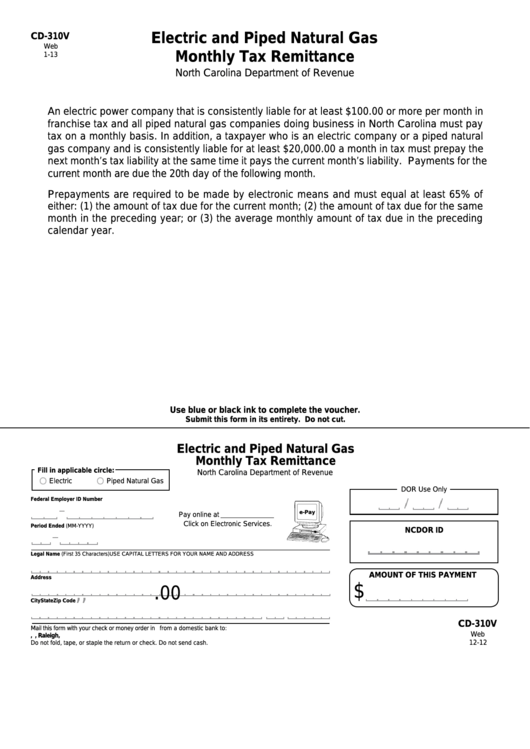

Electric and Piped Natural Gas

CD-310V

Web

Monthly Tax Remittance

1-13

North Carolina Department of Revenue

An electric power company that is consistently liable for at least $100.00 or more per month in

franchise tax and all piped natural gas companies doing business in North Carolina must pay

tax on a monthly basis. In addition, a taxpayer who is an electric company or a piped natural

gas company and is consistently liable for at least $20,000.00 a month in tax must prepay the

next month’s tax liability at the same time it pays the current month’s liability. Payments for the

current month are due the 20th day of the following month.

Prepayments are required to be made by electronic means and must equal at least 65% of

either: (1) the amount of tax due for the current month; (2) the amount of tax due for the same

month in the preceding year; or (3) the average monthly amount of tax due in the preceding

calendar year.

Use blue or black ink to complete the voucher.

Submit this form in its entirety. Do not cut.

Electric and Piped Natural Gas

Monthly Tax Remittance

Fill in applicable circle:

North Carolina Department of Revenue

Electric

Piped Natural Gas

DOR Use Only

Federal Employer ID Number

e-Pay

Pay online at

Click on Electronic Services.

Period Ended (MM-YYYY)

NCDOR ID

Legal Name (First 35 Characters)

USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS

AMOUNT OF THIS PAYMENT

Address

$

.

,

,

00

City

State

Zip Code

CD-310V

Mail this form with your check or money order in U.S. currency from a domestic bank to:

Web

N.C. Department of Revenue, P.O. Box 25000, Raleigh, N.C. 27640-0650.

12-12

Do not fold, tape, or staple the return or check. Do not send cash.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1