Form Cc-046 - Des Child Care Services Information

ADVERTISEMENT

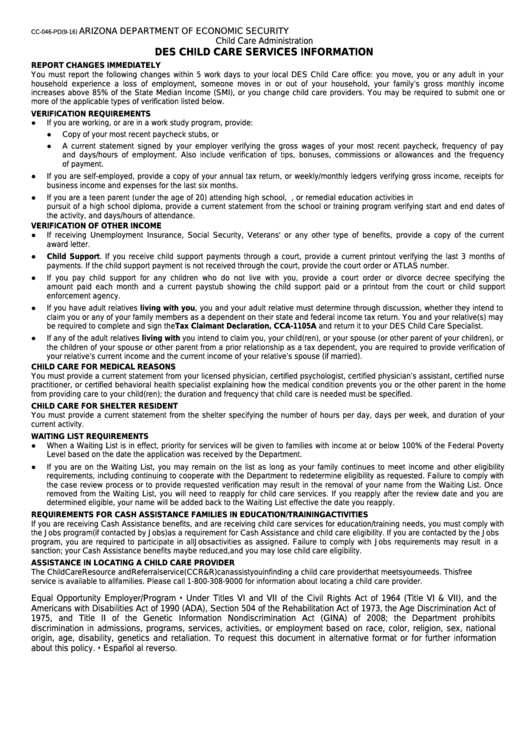

ARIZONA DEPARTMENT OF ECONOMIC SECURITY

CC-046-PD (9-16)

Child Care Administration

DES CHILD CARE SERVICES INFORMATION

REPORT CHANGES IMMEDIATELY

You must report the following changes within 5 work days to your local DES Child Care office: you move, you or any adult in your

household experience a loss of employment, someone moves in or out of your household, your family’s gross monthly income

increases above 85% of the State Median Income (SMI), or you change child care providers. You may be required to submit one or

more of the applicable types of verification listed below.

VERIFICATION REQUIREMENTS

●

If you are working, or are in a work study program, provide:

●

Copy of your most recent paycheck stubs, or

●

A current statement signed by your employer verifying the gross wages of your most recent paycheck, frequency of pay

and days/hours of employment. Also include verification of tips, bonuses, commissions or allowances and the frequency

of payment.

●

If you are self-employed, provide a copy of your annual tax return, or weekly/monthly ledgers verifying gross income, receipts for

business income and expenses for the last six months.

●

If you are a teen parent (under the age of 20) attending high school, G.E.D. or E.S.O.L. classes, or remedial education activities in

pursuit of a high school diploma, provide a current statement from the school or training program verifying start and end dates of

the activity, and days/hours of attendance.

VERIFICATION OF OTHER INCOME

●

If receiving Unemployment Insurance, Social Security, Veterans' or any other type of benefits, provide a copy of the current

award letter.

●

Child Support. If you receive child support payments through a court, provide a current printout verifying the last 3 months of

payments. If the child support payment is not received through the court, provide the court order or ATLAS number.

●

If you pay child support for any children who do not live with you, provide a court order or divorce decree specifying the

amount paid each month and a current paystub showing the child support paid or a printout from the court or child support

enforcement agency.

●

If you have adult relatives living with you, you and your adult relative must determine through discussion, whether they intend to

claim you or any of your family members as a dependent on their state and federal income tax return. You and your relative(s) may

be required to complete and sign the Tax Claimant Declaration, CCA-1105A and return it to your DES Child Care Specialist.

●

If any of the adult relatives living with you intend to claim you, your child(ren), or your spouse (or other parent of your children), or

the children of your spouse or other parent from a prior relationship as a tax dependent, you are required to provide verification of

your relative’s current income and the current income of your relative’s spouse (if married).

CHILD CARE FOR MEDICAL REASONS

You must provide a current statement from your licensed physician, certified psychologist, certified physician’s assistant, certified nurse

practitioner, or certified behavioral health specialist explaining how the medical condition prevents you or the other parent in the home

from providing care to your child(ren); the duration and frequency that child care is needed must be specified.

CHILD CARE FOR SHELTER RESIDENT

You must provide a current statement from the shelter specifying the number of hours per day, days per week, and duration of your

current activity.

WAITING LIST REQUIREMENTS

●

When a Waiting List is in effect, priority for services will be given to families with income at or below 100% of the Federal Poverty

Level based on the date the application was received by the Department.

●

If you are on the Waiting List, you may remain on the list as long as your family continues to meet income and other eligibility

requirements, including continuing to cooperate with the Department to redetermine eligibility as requested. Failure to comply with

the case review process or to provide requested verification may result in the removal of your name from the Waiting List. Once

removed from the Waiting List, you will need to reapply for child care services. If you reapply after the review date and you are

determined eligible, your name will be added back to the Waiting List effective the date you reapply.

REQUIREMENTS FOR CASH ASSISTANCE FAMILIES IN EDUCATION/TRAINING ACTIVITIES

If you are receiving Cash Assistance benefits, and are receiving child care services for education/training needs, you must comply with

the Jobs program (if contacted by Jobs) as a requirement for Cash Assistance and child care eligibility. If you are contacted by the Jobs

program, you are required to participate in all Jobs activities as assigned. Failure to comply with Jobs requirements may result in a

sanction; your Cash Assistance benefits may be reduced, and you may lose child care eligibility.

ASSISTANCE IN LOCATING A CHILD CARE PROVIDER

The Child Care Resource and Referral service (CCR&R) can assist you in finding a child care provider that meets your needs. This free

service is available to all families. Please call 1-800-308-9000 for information about locating a child care provider.

Equal Opportunity Employer/Program • Under Titles VI and VII of the Civil Rights Act of 1964 (Title VI & VII), and the

Americans with Disabilities Act of 1990 (ADA), Section 504 of the Rehabilitation Act of 1973, the Age Discrimination Act of

1975, and Title II of the Genetic Information Nondiscrimination Act (GINA) of 2008; the Department prohibits

discrimination in admissions, programs, services, activities, or employment based on race, color, religion, sex, national

origin, age, disability, genetics and retaliation. To request this document in alternative format or for further information

about this policy. • Español al reverso.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2