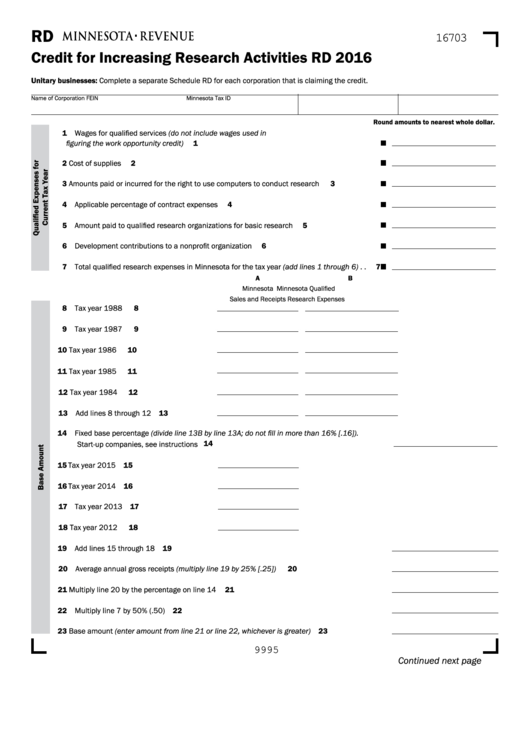

RD

16703

Credit for Increasing Research Activities RD 2016

Unitary businesses: Complete a separate Schedule RD for each corporation that is claiming the credit.

Name of Corporation

FEIN

Minnesota Tax ID

Round amounts to nearest whole dollar.

1 Wages for qualified services (do not include wages used in

figuring the work opportunity credit) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Cost of supplies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Amounts paid or incurred for the right to use computers to conduct research . . . . . . . . . .

3

4 Applicable percentage of contract expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Amount paid to qualified research organizations for basic research . . . . . . . . . . . . . . . . . .

5

6 Development contributions to a nonprofit organization . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Total qualified research expenses in Minnesota for the tax year (add lines 1 through 6) . .

7

A

B

Minnesota

Minnesota Qualified

Sales and Receipts

Research Expenses

8 Tax year 1988 . . . . . . . . . . . . . . . . . .

8

9 Tax year 1987 . . . . . . . . . . . . . . . . . .

9

10 Tax year 1986 . . . . . . . . . . . . . . . . . .

10

11 Tax year 1985 . . . . . . . . . . . . . . . . . .

11

12 Tax year 1984 . . . . . . . . . . . . . . . . . .

12

13 Add lines 8 through 12 . . . . . . . . . . .

13

14 Fixed base percentage (divide line 13B by line 13A; do not fill in more than 16% [.16]).

14

Start-up companies, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15 Tax year 2015 . . . . . . . . . . . . . . . . . .

15

16 Tax year 2014 . . . . . . . . . . . . . . . . . . .

16

17 Tax year 2013 . . . . . . . . . . . . . . . . . .

17

18 Tax year 2012 . . . . . . . . . . . . . . . . . .

18

19 Add lines 15 through 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

20 Average annual gross receipts (multiply line 19 by 25% [.25]) . . . . . . . . . . . . . . . . . . . . . . . .

20

21 Multiply line 20 by the percentage on line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

22 Multiply line 7 by 50% (.50) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

23 Base amount (enter amount from line 21 or line 22, whichever is greater). . . . . . . . . . . . . .

23

9995

Continued next page

1

1 2

2 3

3