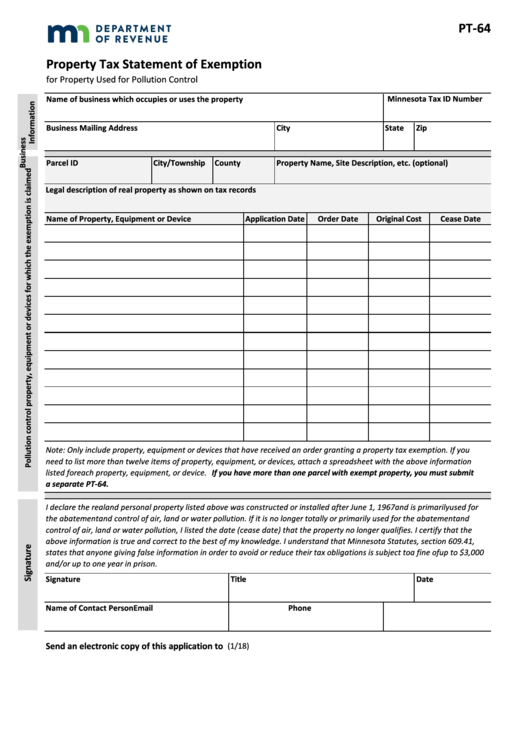

PT-64

Property Tax Statement of Exemption

for Property Used for Pollution Control

Name of business which occupies or uses the property

Minnesota Tax ID Number

Business Mailing Address

City

State

Zip

Parcel ID

City/Township

County

Property Name, Site Description, etc. (optional)

Legal description of real property as shown on tax records

Name of Property, Equipment or Device

Application Date

Order Date

Original Cost

Cease Date

Note: Only include property, equipment or devices that have received an order granting a property tax exemption. If you

need to list more than twelve items of property, equipment, or devices, attach a spreadsheet with the above information

listed for each property, equipment, or device. If you have more than one parcel with exempt property, you must submit

a separate PT-64.

I declare the real and personal property listed above was constructed or installed after June 1, 1967 and is primarily used for

the abatement and control of air, land or water pollution. If it is no longer totally or primarily used for the abatement and

control of air, land or water pollution, I listed the date (cease date) that the property no longer qualifies. I certify that the

above information is true and correct to the best of my knowledge. I understand that Minnesota Statutes, section 609.41,

states that anyone giving false information in order to avoid or reduce their tax obligations is subject to a fine of up to $3,000

and/or up to one year in prison.

Signature

Title

Date

Name of Contact Person

Email

Phone

Send an electronic copy of this application to sa.property@state.mn.us

(1/18)

1

1 2

2