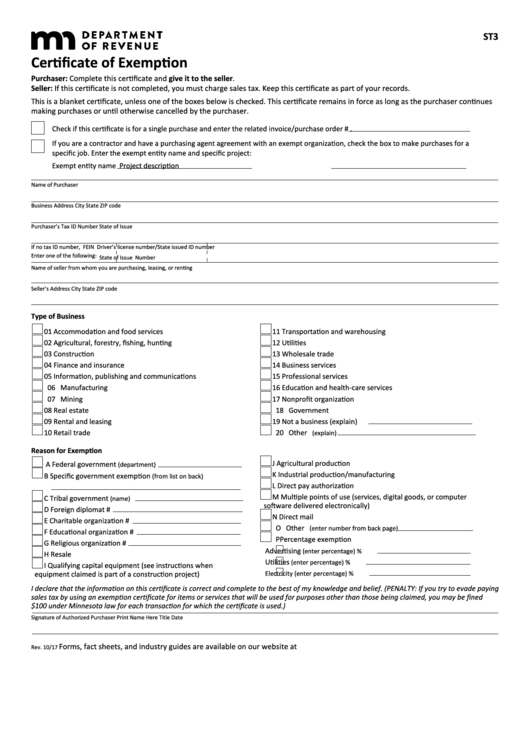

ST3

Certificate of Exemption

Purchaser: Complete this certificate and give it to the seller.

Seller: If this certificate is not completed, you must charge sales tax. Keep this certificate as part of your records.

This is a blanket certificate, unless one of the boxes below is checked. This certificate remains in force as long as the purchaser continues

making purchases or until otherwise cancelled by the purchaser.

Check if this certificate is for a single purchase and enter the related invoice/purchase order #

.

If you are a contractor and have a purchasing agent agreement with an exempt organization, check the box to make purchases for a

specific job. Enter the exempt entity name and specific project:

Exempt entity name

Project description

Name of Purchaser

Business Address

City

State

ZIP code

Purchaser’s Tax ID Number

State of Issue

If no tax ID number,

FEIN

Driver’s license number/State issued ID number

Enter one of the following:

State of Issue

Number

Name of seller from whom you are purchasing, leasing, or renting

Seller’s Address

City

State

ZIP code

Type of Business

01 Accommodation and food services

11 Transportation and warehousing

02 Agricultural, forestry, fishing, hunting

12 Utilities

03 Construction

13 Wholesale trade

04 Finance and insurance

14 Business services

05 Information, publishing and communications

15 Professional services

06 Manufacturing

16 Education and health-care services

07 Mining

17 Nonprofit organization

08 Real estate

18 Government

09 Rental and leasing

19 Not a business (explain)

10 Retail trade

20 Other

(explain)

Reason for Exemption

J

Agricultural production

A Federal government

(department)

K Industrial production/manufacturing

B Specific government exemption

(from list on back)

L

Direct pay authorization

M Multiple points of use (services, digital goods, or computer

C Tribal government

(name)

software delivered electronically)

D Foreign diplomat #

N Direct mail

E Charitable organization #

O Other

(enter number from back page)

F Educational organization #

P Percentage exemption

G Religious organization #

Advertising

(enter percentage)

%

H Resale

Utilities

(enter percentage)

%

I Qualifying capital equipment (see instructions when

equipment claimed is part of a construction project)

Electricity (enter percentage)

%

I declare that the information on this certificate is correct and complete to the best of my knowledge and belief. (PENALTY: If you try to evade paying

sales tax by using an exemption certificate for items or services that will be used for purposes other than those being claimed, you may be fined

$100 under Minnesota law for each transaction for which the certificate is used.)

Signature of Authorized Purchaser

Print Name Here

Title

Date

Forms, fact sheets, and industry guides are available on our website at

Rev. 10/17

1

1 2

2 3

3 4

4 5

5 6

6