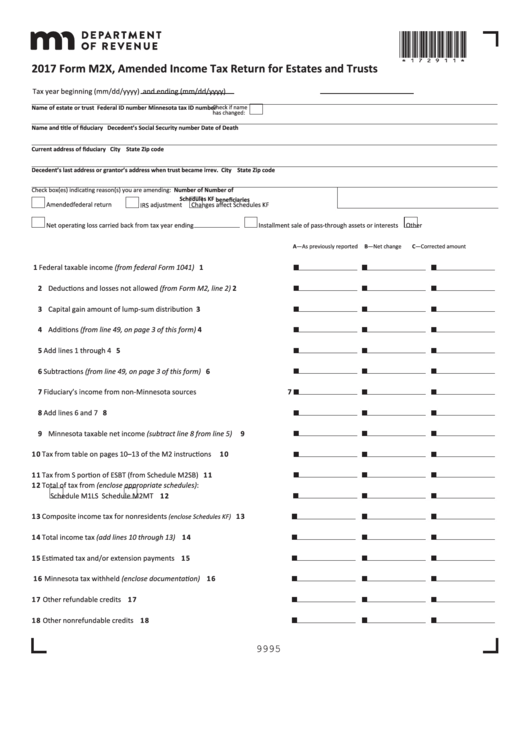

*172911*

2017 Form M2X, Amended Income Tax Return for Estates and Trusts

Tax year beginning (mm/dd/yyyy)

and ending (mm/dd/yyyy)

Name of estate or trust

Check if name

Federal ID number

Minnesota tax ID number

has changed:

Name and title of fiduciary

Decedent’s Social Security number

Date of Death

Current address of fiduciary

City

State

Zip code

Decedent’s last address or grantor’s address when trust became irrev.

City

State

Zip code

Check box(es) indicating reason(s) you are amending:

Number of

Number of

Schedules KF

beneficiaries

Amended federal return

IRS adjustment

Changes affect Schedules KF

Net operating loss carried back from tax year ending

Installment sale of pass-through assets or interests

Other

A—As previously reported

B—Net change

C—Corrected amount

1 Federal taxable income (from federal Form 1041) . . . . . . . . . . . . . . . . . . . . 1

2 Deductions and losses not allowed (from Form M2, line 2) . . . . . . . . . . . . . 2

3 Capital gain amount of lump-sum distribution . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Additions (from line 49, on page 3 of this form) . . . . . . . . . . . . . . . . . . . . . . 4

5 Add lines 1 through 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Subtractions (from line 49, on page 3 of this form) . . . . . . . . . . . . . . . . . . . . 6

7 Fiduciary’s income from non-Minnesota sources . . . . . . . . . . . . . . . . . . . . . 7

8 Add lines 6 and 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Minnesota taxable net income (subtract line 8 from line 5) . . . . . . . . . . . .

9

10

Tax from table on pages 10–13 of the M2 instructions . . . . . . . . . . . . . . 1 0

11

Tax from S portion of ESBT (from Schedule M2SB) . . . . . . . . . . . . . . . . . . 1 1

Total of tax from (enclose appropriate schedules):

12

Schedule M1LS

Schedule M2MT . . . . . . . . . . . . . . . . . . . . . . . 1 2

13

Composite income tax for nonresidents

. . . . . . . . . .

1 3

(enclose Schedules KF)

14

Total income tax (add lines 10 through 13) . . . . . . . . . . . . . . . . . . . . . . . . 1 4

15

Estimated tax and/or extension payments . . . . . . . . . . . . . . . . . . . . . . . . 1 5

Minnesota tax withheld (enclose documentation) . . . . . . . . . . . . . . . . . . 1 6

16

17

Other refundable credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 7

Other nonrefundable credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 8

18

9995

1

1 2

2 3

3 4

4