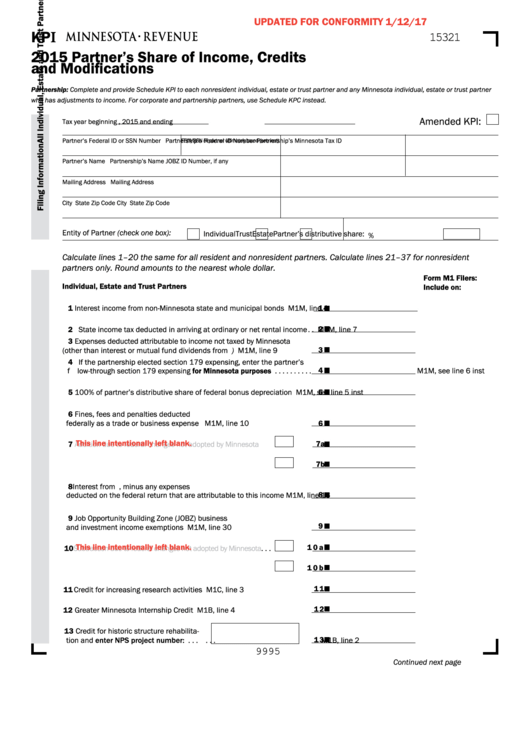

UPDATED FOR CONFORMITY 1/12/17

KPI

15321

2015 Partner’s Share of Income, Credits

and Modifications

Partnership: Complete and provide Schedule KPI to each nonresident individual, estate or trust partner and any Minnesota individual, estate or trust partner

who has adjustments to income. For corporate and partnership partners, use Schedule KPC instead.

Amended KPI:

Tax year beginning

, 2015 and ending

Partner’s Federal ID or SSN Number

Partnership’s Federal ID Number

Partnership’s Minnesota Tax ID

FEIN/SSN of partner ultimately taxed (see inst):

Partner’s Name

Partnership’s Name

JOBZ ID Number, if any

Mailing Address

Mailing Address

City

State

Zip Code

City

State

Zip Code

Entity of Partner (check one box):

Individual

Trust

Estate

Partner’s distributive share:

%

Calculate lines 1–20 the same for all resident and nonresident partners. Calculate lines 21–37 for nonresident

partners only. Round amounts to the nearest whole dollar.

Form M1 Filers:

Individual, Estate and Trust Partners

Include on:

1 Interest income from non-Minnesota state and municipal bonds . . . . . . .

1

M1M, line 4

2

2 State income tax deducted in arriving at ordinary or net rental income . .

M1M, line 7

3 Expenses deducted attributable to income not taxed by Minnesota

(other than interest or mutual fund dividends from U .S . bonds) . . . . . . . .

3

M1M, line 9

4 If the partnership elected section 179 expensing, enter the partner’s

4

flow-through section 179 expensing for Minnesota purposes . . . . . . . . . .

M1M, see line 6 inst

5

5 100% of partner’s distributive share of federal bonus depreciation . . . . .

M1M, see line 5 inst

6 Fines, fees and penalties deducted

federally as a trade or business expense . . . . . . . . . . . . . . . . . . . . . . . . . .

6

M1M, line 10

This line intentionally left blank.

7

Addition due to federal changes not adopted by Minnesota

. . . .

. . . . .

7a

7b

. . . . .

8 Interest from U .S . government bond obligations, minus any expenses

8

deducted on the federal return that are attributable to this income . . . . .

M1M, line 16

9 Job Opportunity Building Zone (JOBZ) business

9

and investment income exemptions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

M1M, line 30

This line intentionally left blank.

1 0 a

10

Subtraction due to federal changes not adopted by

Minnesota . . .

. . . . .

1 0 b

. . . . .

1 1

11 Credit for increasing research activities . . . . . . . . . . . . . . . . . . . . . . . . . . . .

M1C, line 3

1 2

12 Greater Minnesota Internship Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

M1B, line 4

13 Credit for historic structure rehabilita-

tion and enter NPS project number: . . .

. . .

1 3

M1B, line 2

9995

Continued next page

1

1 2

2 3

3 4

4 5

5