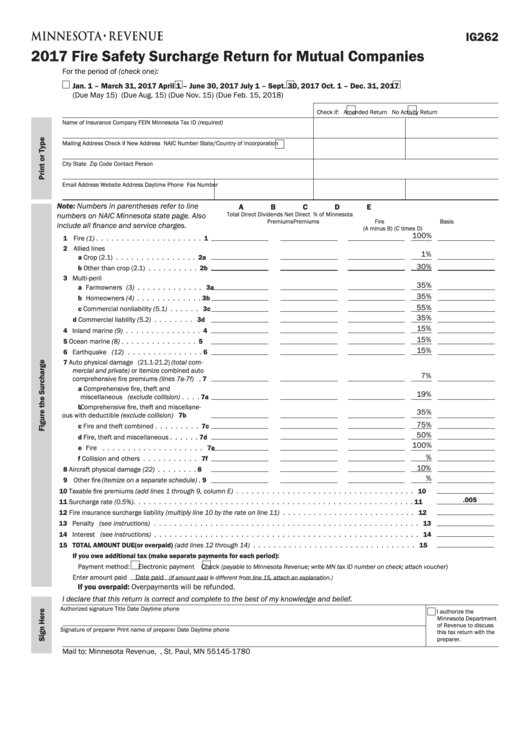

IG262

2017 Fire Safety Surcharge Return for Mutual Companies

For the period of (check one):

Jan. 1 – March 31, 2017

April 1 – June 30, 2017

July 1 – Sept. 30, 2017

Oct. 1 – Dec. 31, 2017

(Due May 15)

(Due Aug. 15)

(Due Nov. 15)

(Due Feb. 15, 2018)

Check if:

Amended Return

No Activity Return

Name of Insurance Company

FEIN

Minnesota Tax ID (required)

Mailing Address

Check if New Address

NAIC Number

State/Country of Incorporation

City

State

Zip Code

Contact Person

Email Address

Website Address

Daytime Phone

Fax Number

Note: Numbers in parentheses refer to line

A

B

C

D

E

numbers on NAIC Minnesota state page. Also

Total Direct

Dividends

Net Direct

% of

Minnesota

Premiums

Premiums

Fire

Basis

include all finance and service charges.

(A minus B)

(C times D)

100%

1 Fire (1) . . . . . . . . . . . . . . . . . . . . . 1

2 Allied lines

1%

a Crop (2 . 1 ) . . . . . . . . . . . . . . . . 2a

30%

b Other than crop (2 . 1 ) . . . . . . . . . . 2b

3 Multi-peril

35%

a Farmowners (3) . . . . . . . . . . . . . 3a

35%

b Homeowners (4) . . . . . . . . . . . . . 3b

55%

c Commercial nonliability (5.1) . . . . . . 3c

35%

d Commercial liability (5.2) . . . . . . . . 3d

15%

4 Inland marine (9) . . . . . . . . . . . . . . . 4

15%

5 Ocean marine (8) . . . . . . . . . . . . . . . 5

15%

6 Earthquake (12) . . . . . . . . . . . . . . . 6

7 Auto physical damage (21 . 1 -21 .2) (total com-

mercial and private) or itemize combined auto

7%

comprehensive fire premiums (lines 7a-7f) . 7

a Comprehensive fire, theft and

19%

miscellaneous (exclude collision) . . . . 7a

b Comprehensive fire, theft and miscellane-

35%

ous with deductible (exclude collision)

7b

75%

c Fire and theft combined . . . . . . . . . 7c

50%

d Fire, theft and miscellaneous . . . . . . 7d

100%

e Fire . . . . . . . . . . . . . . . . . . . . 7e

%

f Collision and others . . . . . . . . . . . 7f

10%

8 Aircraft physical damage (22) . . . . . . . . 8

%

9 Other fire (itemize on a separate schedule) . 9

10 Taxable fire premiums (add lines 1 through 9, column E) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

.005

11 Surcharge rate (0.5%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Fire insurance surcharge liability (multiply line 10 by the rate on line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Penalty (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Interest (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 TOTAL AMOUNT DUE (or overpaid) (add lines 12 through 14) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

If you owe additional tax (make separate payments for each period):

Payment method:

Electronic payment

Check

(payable to Minnesota Revenue; write MN tax ID number on check; attach voucher

)

Enter amount paid

Date paid

(If amount paid is different from line 15, attach an explanation.)

If you overpaid: Overpayments will be refunded .

I declare that this return is correct and complete to the best of my knowledge and belief.

Authorized signature

Title

Date

Daytime phone

I authorize the

Minnesota Department

of Revenue to discuss

Signature of preparer

Print name of preparer

Date

Daytime phone

this tax return with the

preparer .

Mail to: Minnesota Revenue, P.O. Box 1780, St. Paul, MN 55145-1780

1

1 2

2 3

3