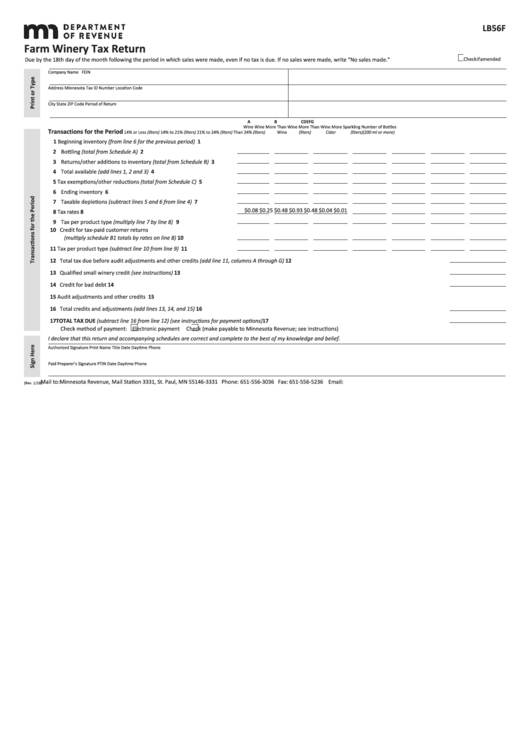

LB56F

Farm Winery Tax Return

Check if amended

Due by the 18th day of the month following the period in which sales were made, even if no tax is due. If no sales were made, write “No sales made.”

Company Name

FEIN

Address

Minnesota Tax ID Number

Location Code

City

State

ZIP Code

Period of Return

A

B

C

D

E

F

G

Wine

Wine More Than

Wine More Than

Wine More

Sparkling

Number of Bottles

Transactions for the Period

14% or Less (liters)

14% to 21% (liters)

21% to 24% (liters)

Than 24% (liters)

Wine (liters)

Cider (liters)

(200 ml or more)

1 Beginning inventory (from line 6 for the previous period) . . . . . . . . . . 1

2 Bottling (total from Schedule A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Returns/other additions to inventory (total from Schedule B) . . . . . . 3

4 Total available (add lines 1, 2 and 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Tax exemptions/other reductions (total from Schedule C) . . . . . . . . . . 5

6 Ending inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Taxable depletions (subtract lines 5 and 6 from line 4) . . . . . . . . . . . . 7

$0.08

$0.25

$0.48

$0.93

$0.48

$0.04

$0.01

8 Tax rates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Tax per product type (multiply line 7 by line 8) . . . . . . . . . . . . . . . . . . . 9

10 Credit for tax-paid customer returns

(multiply schedule B1 totals by rates on line 8) . . . . . . . . . . . . . . . . . . 10

11 Tax per product type (subtract line 10 from line 9) . . . . . . . . . . . . . . 11

12 Total tax due before audit adjustments and other credits (add line 11, columns A through G) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Qualified small winery credit (see instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Credit for bad debt. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Audit adjustments and other credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Total credits and adjustments (add lines 13, 14, and 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 TOTAL TAX DUE (subtract line 16 from line 12) (see instructions for payment options). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

Check method of payment:

Electronic payment

Check (make payable to Minnesota Revenue; see instructions)

I declare that this return and accompanying schedules are correct and complete to the best of my knowledge and belief.

Authorized Signature

Print Name

Title

Date

Daytime Phone

Paid Preparer’s Signature

PTIN

Date

Daytime Phone

Mail to: Minnesota Revenue, Mail Station 3331, St. Paul, MN 55146-3331 Phone: 651-556-3036 Fax: 651-556-5236 Email: alc.taxes@state.mn.us

(Rev. 1/18)

1

1 2

2 3

3 4

4 5

5