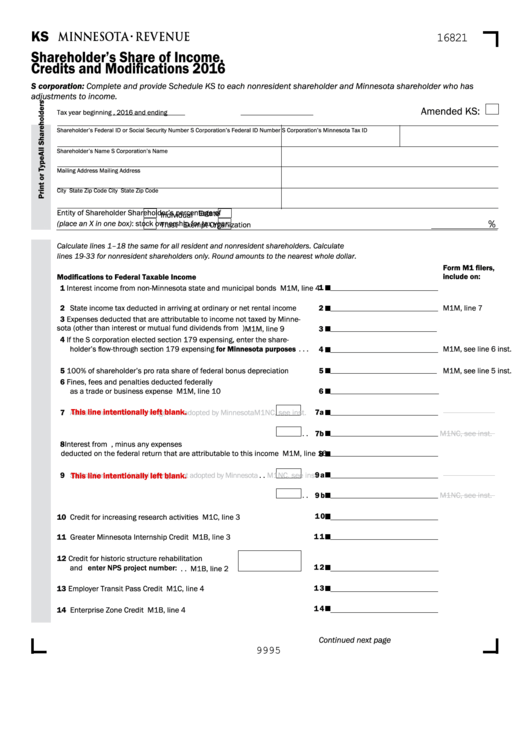

KS

16821

Shareholder’s Share of Income,

Credits and Modifications 2016

S corporation: Complete and provide Schedule KS to each nonresident shareholder and Minnesota shareholder who has

adjustments to income.

Amended KS:

Tax year beginning

, 2016 and ending

Shareholder’s Federal ID or Social Security Number

S Corporation’s Federal ID Number

S Corporation’s Minnesota Tax ID

Shareholder’s Name

S Corporation’s Name

Mailing Address

Mailing Address

City

State

Zip Code

City

State

Zip Code

Entity of Shareholder

Shareholder’s percentage of

Estate

Individual

%

(place an X in one box):

stock ownership for tax year:

Trust

Exempt Organization

Calculate lines 1–18 the same for all resident and nonresident shareholders. Calculate

lines 19-33 for nonresident shareholders only. Round amounts to the nearest whole dollar.

Form M1 filers,

include on:

Modifications to Federal Taxable Income

1

1 Interest income from non-Minnesota state and municipal bonds . . . . . . . .

M1M, line 4

2 State income tax deducted in arriving at ordinary or net rental income . . . .

2

M1M, line 7

3 Expenses deducted that are attributable to income not taxed by Minne-

sota (other than interest or mutual fund dividends from U .S . bonds) . . . . .

3

M1M, line 9

4 If the S corporation elected section 179 expensing, enter the share-

holder’s flow-through section 179 expensing for Minnesota purposes . . .

4

M1M, see line 6 inst .

5 100% of shareholder’s pro rata share of federal bonus depreciation . . . .

5

M1M, see line 5 inst .

6 Fines, fees and penalties deducted federally

6

as a trade or business expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

M1M, line 10

This line intentionally left blank.

7

Addition due to federal changes not adopted by Minnesota

. . . . . .

. . .

7a

M1NC, see inst .

7b

. .

M1NC, see inst .

8 Interest from U .S . government bond obligations, minus any expenses

deducted on the federal return that are attributable to this income . . . . . .

8

M1M, line 16

9 a

9

Subtraction due to federal changes not adopted by

This line intentionally left blank.

Minnesota . . . . .

. .

M1NC, see inst .

9 b

. .

M1NC, see inst .

1 0

10 Credit for increasing research activities . . . . . . . . . . . . . . . . . . . . . . . . . . . .

M1C, line 3

11 Greater Minnesota Internship Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 1

M1B, line 3

12 Credit for historic structure rehabilitation

1 2

and enter NPS project number: . . . . . . . . . . . . . . .

. .

M1B, line 2

1 3

13 Employer Transit Pass Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

M1C, line 4

1 4

14 Enterprise Zone Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

M1B, line 4

Continued next page

9995

1

1 2

2 3

3