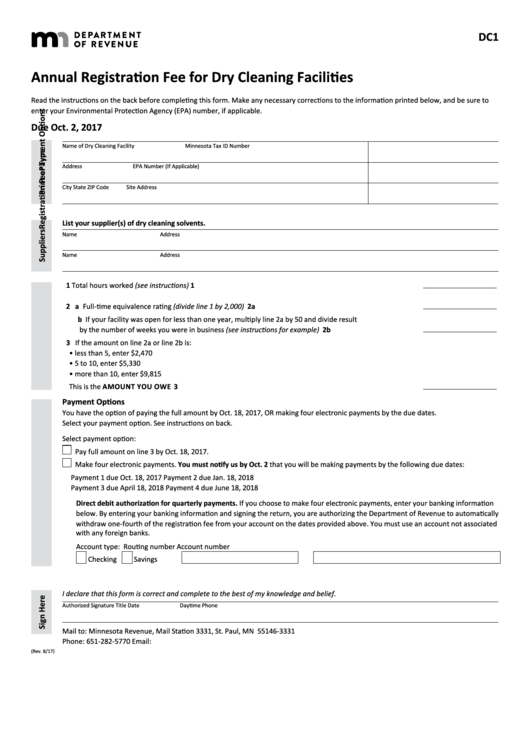

DC1

Annual Registration Fee for Dry Cleaning Facilities

Read the instructions on the back before completing this form. Make any necessary corrections to the information printed below, and be sure to

enter your Environmental Protection Agency (EPA) number, if applicable.

Due Oct. 2, 2017

Name of Dry Cleaning Facility

Minnesota Tax ID Number

Address

EPA Number (If Applicable)

City

State

ZIP Code

Site Address

List your supplier(s) of dry cleaning solvents.

Name

Address

Name

Address

1 Total hours worked (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 a Full-time equivalence rating (divide line 1 by 2,000) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a

b If your facility was open for less than one year, multiply line 2a by 50 and divide result

by the number of weeks you were in business (see instructions for example) . . . . . . . . . . . . . . . . . . . . . . 2b

3 If the amount on line 2a or line 2b is:

• less than 5, enter $2,470

• 5 to 10, enter $5,330

• more than 10, enter $9,815

This is the AMOUNT YOU OWE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3

Payment Options

You have the option of paying the full amount by Oct. 18, 2017, OR making four electronic payments by the due dates.

Select your payment option. See instructions on back.

Select payment option:

Pay full amount on line 3 by Oct. 18, 2017.

Make four electronic payments. You must notify us by Oct. 2 that you will be making payments by the following due dates:

Payment 1 due Oct. 18, 2017

Payment 2 due Jan. 18, 2018

Payment 3 due April 18, 2018

Payment 4 due June 18, 2018

Direct debit authorization for quarterly payments. If you choose to make four electronic payments, enter your banking information

below. By entering your banking information and signing the return, you are authorizing the Department of Revenue to automatically

withdraw one-fourth of the registration fee from your account on the dates provided above. You must use an account not associated

with any foreign banks.

Account type:

Routing number

Account number

Checking

Savings

I declare that this form is correct and complete to the best of my knowledge and belief.

Authorized Signature

Title

Date

Daytime Phone

Mail to: Minnesota Revenue, Mail Station 3331, St. Paul, MN 55146-3331

Phone: 651-282-5770 Email: environmental.tax@state.mn.us

(Rev. 8/17)

1

1 2

2