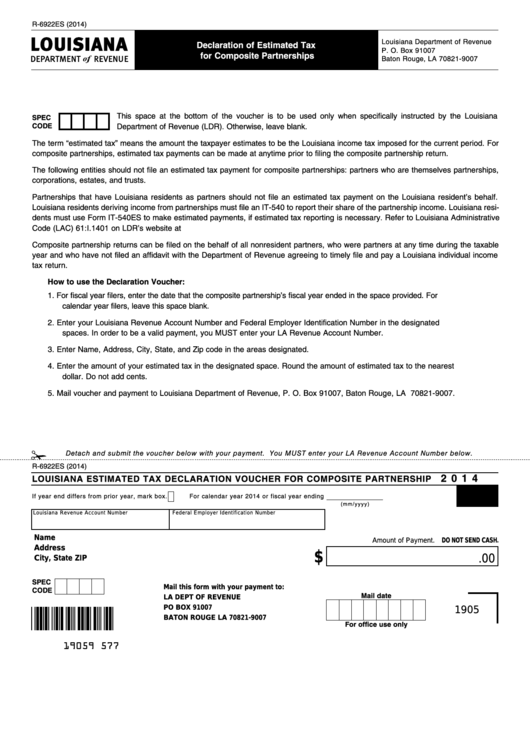

R-6922ES (2014)

Louisiana Department of Revenue

Declaration of Estimated Tax

P. O. Box 91007

for Composite partnerships

Baton Rouge, LA 70821-9007

This space at the bottom of the voucher is to be used only when specifically instructed by the Louisiana

SpEC

CODE

Department of Revenue (LDR). Otherwise, leave blank.

The term “estimated tax” means the amount the taxpayer estimates to be the Louisiana income tax imposed for the current period. For

composite partnerships, estimated tax payments can be made at anytime prior to filing the composite partnership return.

The following entities should not file an estimated tax payment for composite partnerships: partners who are themselves partnerships,

corporations, estates, and trusts.

Partnerships that have Louisiana residents as partners should not file an estimated tax payment on the Louisiana resident’s behalf.

Louisiana residents deriving income from partnerships must file an IT-540 to report their share of the partnership income. Louisiana resi-

dents must use Form IT-540ES to make estimated payments, if estimated tax reporting is necessary. Refer to Louisiana Administrative

Code (LAC) 61:I.1401 on LDR’s website at

Composite partnership returns can be filed on the behalf of all nonresident partners, who were partners at any time during the taxable

year and who have not filed an affidavit with the Department of Revenue agreeing to timely file and pay a Louisiana individual income

tax return.

How to use the Declaration Voucher:

1.

For fiscal year filers, enter the date that the composite partnership’s fiscal year ended in the space provided. For

calendar year filers, leave this space blank.

2.

Enter your Louisiana Revenue Account Number and Federal Employer Identification Number in the designated

spaces. In order to be a valid payment, you MUST enter your LA Revenue Account Number.

3.

Enter Name, Address, City, State, and Zip code in the areas designated.

4.

Enter the amount of your estimated tax in the designated space. Round the amount of estimated tax to the nearest

dollar. Do not add cents.

5.

Mail voucher and payment to Louisiana Department of Revenue, P. O. Box 91007, Baton Rouge, LA 70821-9007.

Detach and submit the voucher below with your payment. You MUST enter your LA Revenue Account Number below.

R-6922ES (2014)

2 0 1 4

LOUISIANA ESTIMATED TAX DECLARATION VOUCHER FOR COMpOSITE pARTNERSHIp

C.p.

If year end differs from prior year, mark box.

For calendar year 2014 or fiscal year ending

(m m /y y y y )

Louisiana Revenue Account Number

Federal Employer Identification Number

Name

Amount of Payment.

DO NOT SEND CASH.

Address

$

.00

City, State ZIP

SpEC

Mail this form with your payment to:

CODE

Mail date

LA DEPT OF REVENUE

PO BOX 91007

1905

BATON ROUGE LA 70821-9007

For office use only

19059

577

1

1