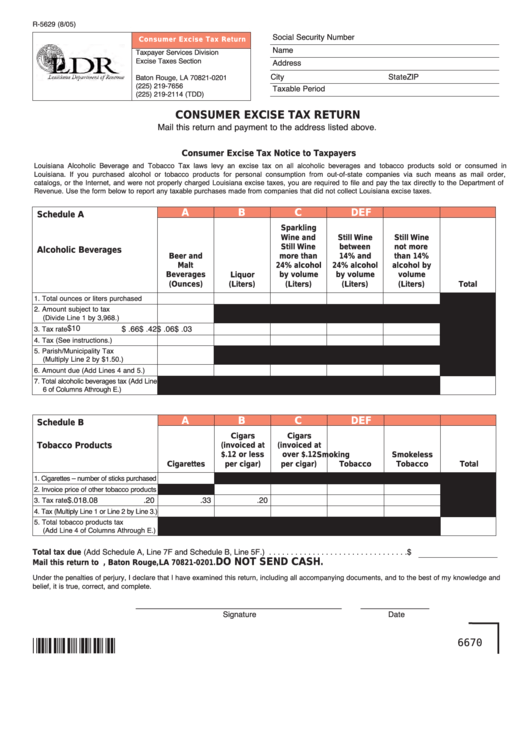

R-5629 (8/05)

Social Security Number

Consumer Excise Tax Return

Name

Taxpayer Services Division

Excise Taxes Section

Address

P.O. Box 201

City

State

ZIP

Baton Rouge, LA 70821-0201

(225) 219-7656

Taxable Period

(225) 219-2114 (TDD)

CONSUMER EXCISE TAX RETURN

Mail this return and payment to the address listed above.

Consumer Excise Tax Notice to Taxpayers

Louisiana Alcoholic Beverage and Tobacco Tax laws levy an excise tax on all alcoholic beverages and tobacco products sold or consumed in

Louisiana. If you purchased alcohol or tobacco products for personal consumption from out-of-state companies via such means as mail order,

catalogs, or the Internet, and were not properly charged Louisiana excise taxes, you are required to file and pay the tax directly to the Department of

Revenue. Use the form below to report any taxable purchases made from companies that did not collect Louisiana excise taxes.

A

B

C

D

E

F

Schedule A

Sparkling

Wine and

Still Wine

Still Wine

Still Wine

between

not more

Alcoholic Beverages

Beer and

more than

14% and

than 14%

Malt

24% alcohol

24% alcohol

alcohol by

Beverages

Liquor

by volume

by volume

volume

(Ounces)

(Liters)

(Liters)

(Liters)

(Liters)

Total

1. Total ounces or liters purchased

2. Amount subject to tax

(Divide Line 1 by 3,968.)

$10

$ .66

$ .42

$ .06

$ .03

3. Tax rate

4. Tax (See instructions.)

5. Parish/Municipality Tax

(Multiply Line 2 by $1.50.)

6. Amount due (Add Lines 4 and 5.)

7. Total alcoholic beverages tax (Add Line

6 of Columns A through E.)

A

B

C

D

E

F

Schedule B

Cigars

Cigars

Tobacco Products

(invoiced at

(invoiced at

$.12 or less

over $.12

Smoking

Smokeless

Cigarettes

per cigar)

per cigar)

Tobacco

Tobacco

Total

1. Cigarettes – number of sticks purchased

2. Invoice price of other tobacco products

3. Tax rate

$.018

.08

.20

.33

.20

4. Tax (Multiply Line 1 or Line 2 by Line 3.)

5. Total tobacco products tax

(Add Line 4 of Columns A through E.)

Total tax due (Add Schedule A, Line 7F and Schedule B, Line 5F.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

DO NOT SEND CASH.

Mail this return to P.O. Box 201, Baton Rouge, LA 70821-0201.

Under the penalties of perjury, I declare that I have examined this return, including all accompanying documents, and to the best of my knowledge and

belief, it is true, correct, and complete.

____________________________________

____________

Signature

Date

6670

1

1 2

2