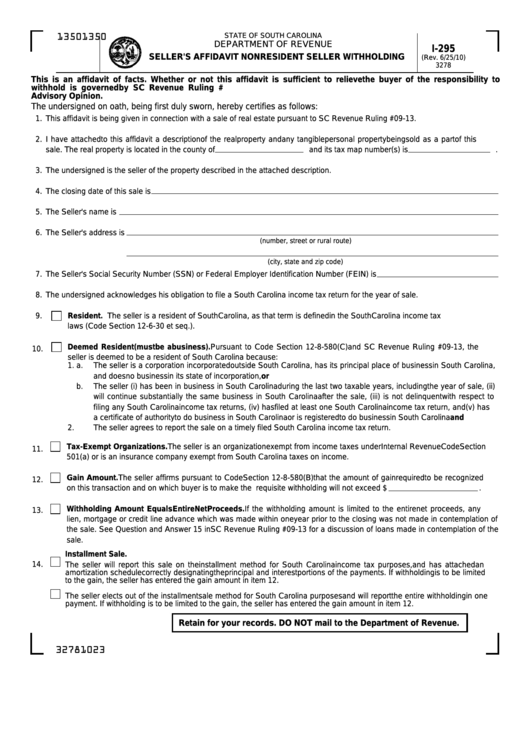

Form I-295 - Seller'S Affidavit Nonresident Seller Withholding

ADVERTISEMENT

STATE OF SOUTH CAROLINA

1350

1350

DEPARTMENT OF REVENUE

I-295

SELLER'S AFFIDAVIT NONRESIDENT SELLER WITHHOLDING

(Rev. 6/25/10)

3278

S.C. Code Section 12-8-580

This is an affidavit of facts. Whether or not this affidavit is sufficient to relieve the buyer of the responsibility to

withhold is governed by SC Revenue Ruling #09-13. Please read this affidavit carefully in conjunction with this

Advisory Opinion.

The undersigned on oath, being first duly sworn, hereby certifies as follows:

1.

This affidavit is being given in connection with a sale of real estate pursuant to SC Revenue Ruling #09-13.

2.

I have attached to this affidavit a description of the real property and any tangible personal property being sold as a part of this

sale. The real property is located in the county of

and its tax map number(s) is

.

3.

The undersigned is the seller of the property described in the attached description.

4.

The closing date of this sale is

5.

The Seller's name is

6.

The Seller's address is

(number, street or rural route)

(city, state and zip code)

7.

The Seller's Social Security Number (SSN) or Federal Employer Identification Number (FEIN) is

8.

The undersigned acknowledges his obligation to file a South Carolina income tax return for the year of sale.

9.

Resident. The seller is a resident of South Carolina, as that term is defined in the South Carolina income tax

laws (Code Section 12-6-30 et seq.).

Deemed Resident (must be a business). Pursuant to Code Section 12-8-580(C) and SC Revenue Ruling #09-13, the

10.

seller is deemed to be a resident of South Carolina because:

1. a.

The seller is a corporation incorporated outside South Carolina, has its principal place of business in South Carolina,

and does no business in its state of incorporation, or

b.

The seller (i) has been in business in South Carolina during the last two taxable years, including the year of sale, (ii)

will continue substantially the same business in South Carolina after the sale, (iii) is not delinquent with respect to

filing any South Carolina income tax returns, (iv) has filed at least one South Carolina income tax return, and (v) has

a certificate of authority to do business in South Carolina or is registered to do business in South Carolina and

2.

The seller agrees to report the sale on a timely filed South Carolina income tax return.

Tax-Exempt Organizations. The seller is an organization exempt from income taxes under Internal Revenue Code Section

11.

501(a) or is an insurance company exempt from South Carolina taxes on income.

Gain Amount. The seller affirms pursuant to Code Section 12-8-580(B) that the amount of gain required to be recognized

12.

on this transaction and on which buyer is to make the requisite withholding will not exceed $

.

Withholding Amount Equals Entire Net Proceeds. If the withholding amount is limited to the entire net proceeds, any

13.

lien, mortgage or credit line advance which was made within one year prior to the closing was not made in contemplation of

the sale. See Question and Answer 15 in SC Revenue Ruling #09-13 for a discussion of loans made in contemplation of the

sale.

Installment Sale.

14.

The seller will report this sale on the installment method for South Carolina income tax purposes, and has attached an

amortization schedule correctly designating the principal and interest portions of the payments. If withholding is to be limited

to the gain, the seller has entered the gain amount in item 12.

The seller elects out of the installment sale method for South Carolina purposes and will report the entire withholding in one

payment. If withholding is to be limited to the gain, the seller has entered the gain amount in item 12.

Retain for your records. DO NOT mail to the Department of Revenue.

32781023

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2