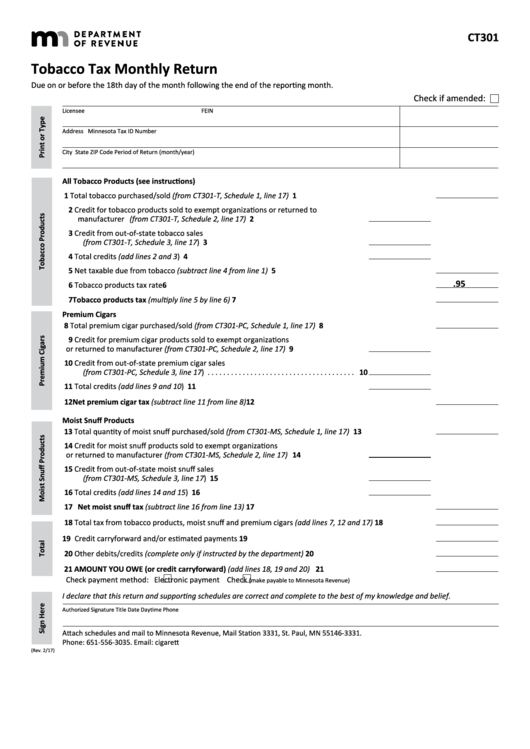

CT301

Tobacco Tax Monthly Return

Due on or before the 18th day of the month following the end of the reporting month.

Check if amended:

Licensee

FEIN

Address

Minnesota Tax ID Number

City

State

ZIP Code

Period of Return (month/year)

All Tobacco Products (see instructions)

1 Total tobacco purchased/sold (from CT301-T, Schedule 1, line 17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Credit for tobacco products sold to exempt organizations or returned to

manufacturer (from CT301-T, Schedule 2, line 17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Credit from out-of-state tobacco sales

(from CT301-T, Schedule 3, line 17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Total credits (add lines 2 and 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Net taxable due from tobacco (subtract line 4 from line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

.95

6 Tobacco products tax rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Tobacco products tax (multiply line 5 by line 6). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Premium Cigars

8 Total premium cigar purchased/sold (from CT301-PC, Schedule 1, line 17) . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Credit for premium cigar products sold to exempt organizations

or returned to manufacturer (from CT301-PC, Schedule 2, line 17) . . . . . . . . . . . . . . . 9

10 Credit from out-of-state premium cigar sales

(from CT301-PC, Schedule 3, line 17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Total credits (add lines 9 and 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Net premium cigar tax (subtract line 11 from line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Moist Snuff Products

13 Total quantity of moist snuff purchased/sold (from CT301-MS, Schedule 1, line 17) . . . . . . . . . . . . . . . . . . 13

14 Credit for moist snuff products sold to exempt organizations

or returned to manufacturer (from CT301-MS, Schedule 2, line 17) . . . . . . . . . . . . . 14

15 Credit from out-of-state moist snuff sales

(from CT301-MS, Schedule 3, line 17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Total credits (add lines 14 and 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Net moist snuff tax (subtract line 16 from line 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Total tax from tobacco products, moist snuff and premium cigars (add lines 7, 12 and 17) . . . . . . . . . . . 18

19 Credit carryforward and/or estimated payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20 Other debits/credits (complete only if instructed by the department). . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

21 AMOUNT YOU OWE (or credit carryforward) (add lines 18, 19 and 20) . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

Check payment method:

Electronic payment

Check

(make payable to Minnesota Revenue)

I declare that this return and supporting schedules are correct and complete to the best of my knowledge and belief.

Authorized Signature

Title

Date

Daytime Phone

Attach schedules and mail to Minnesota Revenue, Mail Station 3331, St. Paul, MN 55146-3331.

Phone: 651-556-3035. Email: cigarette.tobacco@state.mn.us

(Rev. 2/17)

1

1 2

2 3

3