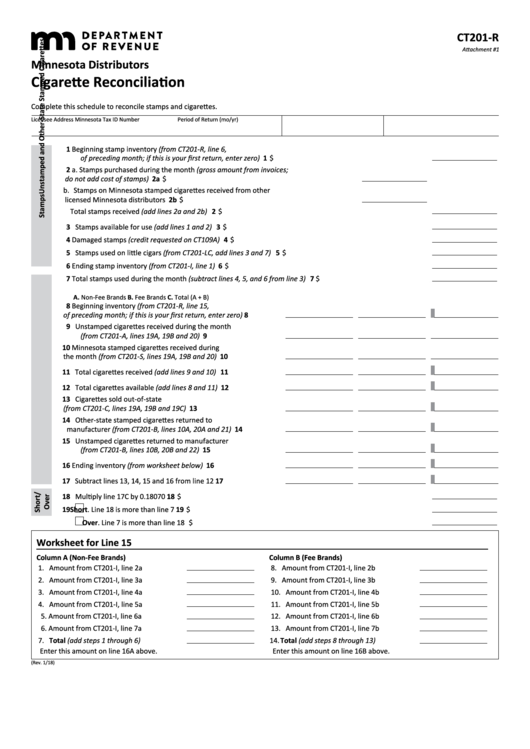

CT201-R

Attachment #1

Minnesota Distributors

Cigarette Reconciliation

Complete this schedule to reconcile stamps and cigarettes.

Licensee

Address

Minnesota Tax ID Number

Period of Return (mo/yr)

1 Beginning stamp inventory (from CT201-R, line 6,

of preceding month; if this is your first return, enter zero) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 $

2 a . Stamps purchased during the month (gross amount from invoices;

do not add cost of stamps) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a $

b. Stamps on Minnesota stamped cigarettes received from other

licensed Minnesota distributors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b $

Total stamps received (add lines 2a and 2b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 $

3 Stamps available for use (add lines 1 and 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 $

4 Damaged stamps (credit requested on CT109A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 $

5 Stamps used on little cigars (from CT201-LC, add lines 3 and 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 $

6 Ending stamp inventory (from CT201-I, line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 $

7 Total stamps used during the month (subtract lines 4, 5, and 6 from line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 $

A. Non-Fee Brands

B. Fee Brands

C. Total (A + B)

8 Beginning inventory (from CT201-R, line 15,

of preceding month; if this is your first return, enter zero) . . . . 8

9 Unstamped cigarettes received during the month

(from CT201-A, lines 19A, 19B and 20) . . . . . . . . . . . . . . . . . . . . 9

10 Minnesota stamped cigarettes received during

the month (from CT201-S, lines 19A, 19B and 20) . . . . . . . . . . 10

11 Total cigarettes received (add lines 9 and 10) . . . . . . . . . . . . . . 11

12 Total cigarettes available (add lines 8 and 11) . . . . . . . . . . . . . . 12

13 Cigarettes sold out-of-state

(from CT201-C, lines 19A, 19B and 19C) . . . . . . . . . . . . . . . . . . 13

14 Other-state stamped cigarettes returned to

manufacturer (from CT201-B, lines 10A, 20A and 21) . . . . . . . 14

15 Unstamped cigarettes returned to manufacturer

(from CT201-B, lines 10B, 20B and 22) . . . . . . . . . . . . . . . . . . . 15

16 Ending inventory (from worksheet below) . . . . . . . . . . . . . . . . 16

17 Subtract lines 13, 14, 15 and 16 from line 12 . . . . . . . . . . . . . . 17

18 Multiply line 17C by 0.18070 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18 $

19

Short. Line 18 is more than line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19 $

Over. Line 7 is more than line 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

Worksheet for Line 15

Column A (Non-Fee Brands)

Column B (Fee Brands)

1. Amount from CT201-I, line 2a . . . . . . . . . .

8. Amount from CT201-I, line 2b . . . . . . . . . .

2. Amount from CT201-I, line 3a . . . . . . . . . .

9. Amount from CT201-I, line 3b . . . . . . . . . .

3. Amount from CT201-I, line 4a . . . . . . . . . .

1 0. Amount from CT201-I, line 4b . . . . . . . . . .

4. Amount from CT201-I, line 5a . . . . . . . . . .

1 1. Amount from CT201-I, line 5b . . . . . . . . . .

5. Amount from CT201-I, line 6a . . . . . . . . . .

1 2. Amount from CT201-I, line 6b . . . . . . . . . .

6. Amount from CT201-I, line 7a . . . . . . . . .

1 3. Amount from CT201-I, line 7b . . . . . . . . . .

7. Total (add steps 1 through 6) . . . . . . . . . . .

14 . Total (add steps 8 through 13) . . . . . . . . .

Enter this amount on line 16A above .

Enter this amount on line 16B above .

(Rev. 1/18)

1

1