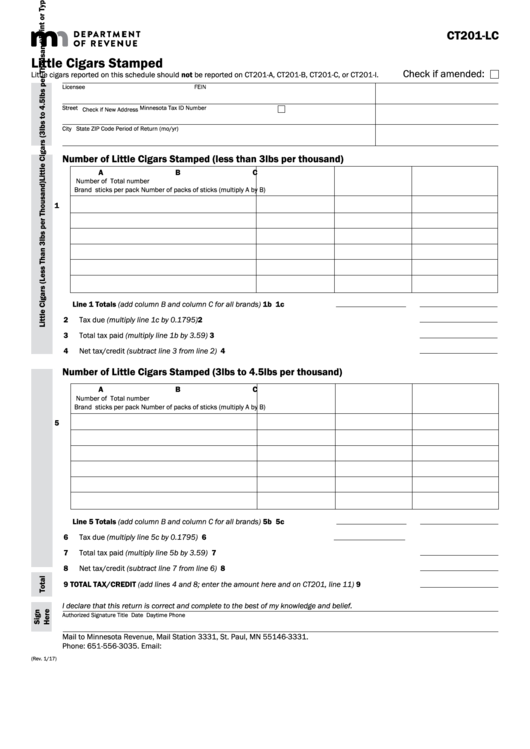

CT201-LC

Little Cigars Stamped

Check if amended:

Little cigars reported on this schedule should not be reported on CT201-A, CT201-B, CT201-C, or CT201-I .

Licensee

FEIN

Street

Minnesota Tax ID Number

Check if New Address

City

State

ZIP Code

Period of Return (mo/yr)

Number of Little Cigars Stamped (less than 3lbs per thousand)

A

B

C

Number of

Total number

Brand

sticks per pack

Number of packs

of sticks (multiply A by B)

1

Line 1 Totals (add column B and column C for all brands) . . . . . . . . . . . . . . . 1b

1c

2 Tax due (multiply line 1c by 0.1795) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Total tax paid (multiply line 1b by 3.59) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Net tax/credit (subtract line 3 from line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Number of Little Cigars Stamped (3lbs to 4.5lbs per thousand)

A

B

C

Number of

Total number

Brand

sticks per pack

Number of packs

of sticks (multiply A by B)

5

Line 5 Totals (add column B and column C for all brands) . . . . . . . . . . . . . . . 5b

5c

6 Tax due (multiply line 5c by 0.1795) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Total tax paid (multiply line 5b by 3.59) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Net tax/credit (subtract line 7 from line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 TOTAL TAX/CREDIT (add lines 4 and 8; enter the amount here and on CT201, line 11) . . . . . . . . . . . . . 9

I declare that this return is correct and complete to the best of my knowledge and belief.

Authorized Signature

Title

Date

Daytime Phone

Mail to Minnesota Revenue, Mail Station 3331, St . Paul, MN 55146-3331 .

Phone: 651-556-3035 . Email: cigarette .tobacco@state .mn .us

(Rev . 1/17)

1

1 2

2