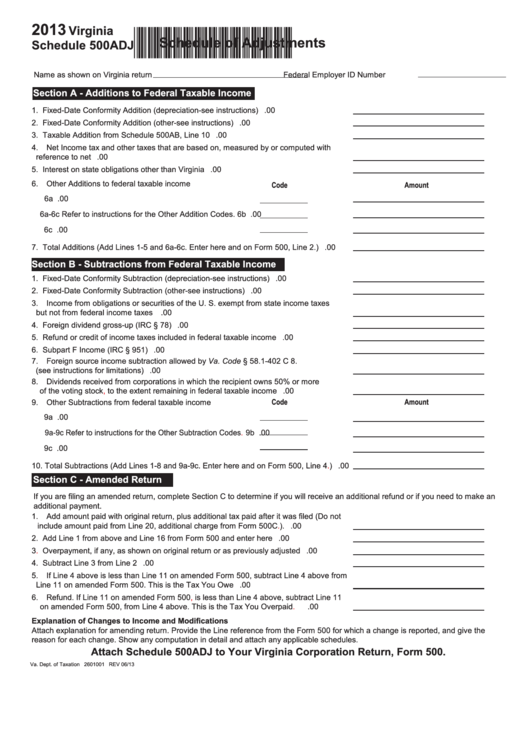

2013

Virginia

*VA500J113000*

Schedule of Adjustments

Schedule 500ADJ

Name as shown on Virginia return

Federal Employer ID Number

Section A - Additions to Federal Taxable Income

1. Fixed-Date Conformity Addition (depreciation-see instructions) ....................................... 1

.00

2. Fixed-Date Conformity Addition (other-see instructions) . .................................................. 2

.00

3. Taxable Addition from Schedule 500AB, Line 10 .............................................................. 3

.00

4. Net Income tax and other taxes that are based on, measured by or computed with

reference to net income..................................................................................................... 4

.00

5. Interest on state obligations other than Virginia ................................................................ 5

.00

6. Other Additions to federal taxable income

Code

Amount

6a

.00

6a-6c Refer to instructions for the Other Addition Codes. 6b

.00

6c

.00

7. Total Additions (Add Lines 1-5 and 6a-6c. Enter here and on Form 500, Line 2.) ............ 7

.00

Section B - Subtractions from Federal Taxable Income

1. Fixed-Date Conformity Subtraction (depreciation-see instructions) .................................. 1

.00

2. Fixed-Date Conformity Subtraction (other-see instructions) ............................................. 2

.00

3. Income from obligations or securities of the U. S. exempt from state income taxes

but not from federal income taxes .................................................................................... 3

.00

4. Foreign dividend gross-up (IRC § 78) ............................................................................... 4

.00

5. Refund or credit of income taxes included in federal taxable income ............................... 5

.00

6. Subpart F Income (IRC § 951) .......................................................................................... 6

.00

7. Foreign source income subtraction allowed by Va. Code § 58.1-402 C 8.

(see instructions for limitations) . ........................................................................................ 7

.00

8. Dividends received from corporations in which the recipient owns 50% or more

of the voting stock, to the extent remaining in federal taxable income . ............................. 8

.00

Code

Amount

9. Other Subtractions from federal taxable income

9a

.00

9a-9c Refer to instructions for the Other Subtraction Codes. 9b

.00

9c

.00

10. Total Subtractions (Add Lines 1-8 and 9a-9c. Enter here and on Form 500, Line 4.) ..... 10

.00

Section C - Amended Return

If you are filing an amended return, complete Section C to determine if you will receive an additional refund or if you need to make an

additional payment.

1. Add amount paid with original return, plus additional tax paid after it was filed (Do not

include amount paid from Line 20, additional charge from Form 500C.). ......................... 1

.00

2. Add Line 1 from above and Line 16 from Form 500 and enter here ................................. 2

.00

3. Overpayment, if any, as shown on original return or as previously adjusted .................... 3

.00

4. Subtract Line 3 from Line 2 ............................................................................................... 4

.00

5. If Line 4 above is less than Line 11 on amended Form 500, subtract Line 4 above from

Line 11 on amended Form 500. This is the Tax You Owe ................................................. 5

.00

6. Refund. If Line 11 on amended Form 500, is less than Line 4 above, subtract Line 11

on amended Form 500, from Line 4 above. This is the Tax You Overpaid. . .................... 6

.00

Explanation of Changes to Income and Modifications

Attach explanation for amending return. Provide the Line reference from the Form 500 for which a change is reported, and give the

reason for each change. Show any computation in detail and attach any applicable schedules.

Attach Schedule 500ADJ to Your Virginia Corporation Return, Form 500.

Va. Dept. of Taxation 2601001 REV 06/13

1

1 2

2