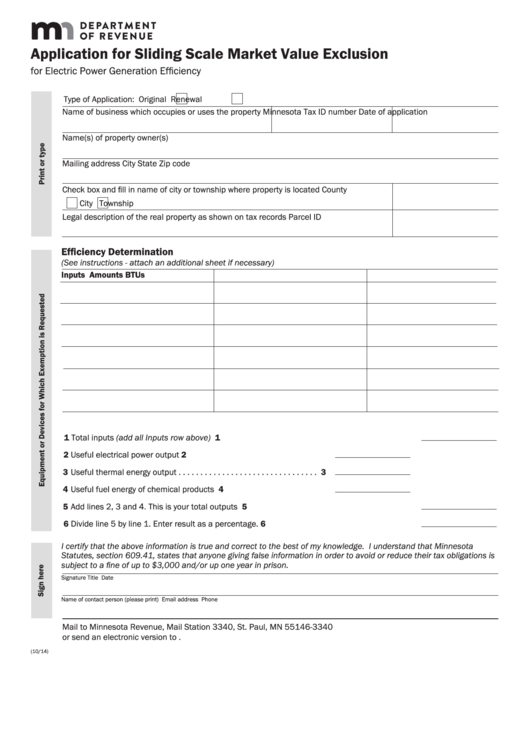

Application for Sliding Scale Market Value Exclusion

for Electric Power Generation Efficiency

Type of Application:

Original

Renewal

Name of business which occupies or uses the property

Minnesota Tax ID number

Date of application

Name(s) of property owner(s)

Mailing address

City

State

Zip code

Check box and fill in name of city or township where property is located

County

City

Township

Legal description of the real property as shown on tax records

Parcel ID

Efficiency Determination

(See instructions - attach an additional sheet if necessary)

Inputs

Amounts

BTUs

1 Total inputs (add all Inputs row above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Useful electrical power output . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Useful thermal energy output . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Useful fuel energy of chemical products . . . . . . . . . . . . . . . . . . . . . . . 4

5 Add lines 2, 3 and 4 . This is your total outputs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Divide line 5 by line 1 . Enter result as a percentage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

I certify that the above information is true and correct to the best of my knowledge. I understand that Minnesota

Statutes, section 609.41, states that anyone giving false information in order to avoid or reduce their tax obligations is

subject to a fine of up to $3,000 and/or up one year in prison.

Signature

Title

Date

Name of contact person (please print)

Email address

Phone

Mail to Minnesota Revenue, Mail Station 3340, St . Paul, MN 55146-3340

or send an electronic version to sa.property@state.mn.us .

(10/14)

1

1 2

2