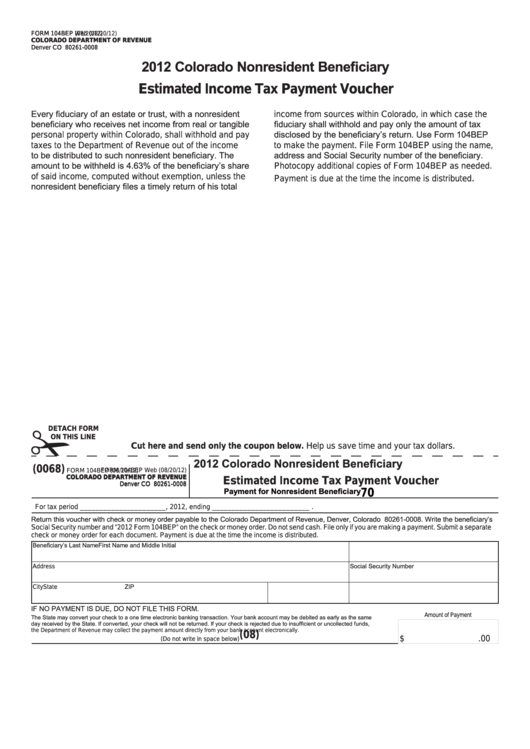

FORM 104BEP (08/20/12)

FORM 104BEP Web (08/20/12)

COLORADO DEPARTMENT OF REVENUE

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0008

Denver CO 80261-0008

2012 Colorado Nonresident Beneficiary

Estimated Income Tax Payment Voucher

Every fiduciary of an estate or trust, with a nonresident

income from sources within Colorado, in which case the

beneficiary who receives net income from real or tangible

fiduciary shall withhold and pay only the amount of tax

disclosed by the beneficiary’s return. Use Form 104BEP

personal property within Colorado, shall withhold and pay

taxes to the Department of Revenue out of the income

to make the payment. File Form 104BEP using the name,

to be distributed to such nonresident beneficiary. The

address and Social Security number of the beneficiary.

amount to be withheld is 4.63% of the beneficiary’s share

Photocopy additional copies of Form 104BEP as needed.

of said income, computed without exemption, unless the

.

Payment is due at the time the income is distributed

nonresident beneficiary files a timely return of his total

DETACH FORM

ON THIS LINE

Cut here and send only the coupon below. Help us save time and your tax dollars.

2012 Colorado Nonresident Beneficiary

(0068)

FORM 104BEP Web (08/20/12)

FORM 104BEP (08/20/12)

COLORADO DEPARTMENT OF REVENUE

COLORADO DEPARTMENT OF REVENUE

Estimated Income Tax Payment Voucher

Denver CO 80261-0008

Denver CO 80261-0008

Payment for Nonresident Beneficiary

70

For tax period ______________________, 2012, ending _________________________ .

Return this voucher with check or money order payable to the Colorado Department of Revenue, Denver, Colorado 80261-0008. Write the beneficiary’s

Social Security number and “2012 Form 104BEP” on the check or money order. Do not send cash. File only if you are making a payment. Submit a separate

check or money order for each document. Payment is due at the time the income is distributed.

Beneficiary’s Last Name

First Name and Middle Initial

Social Security Number

Address

ZIP

City

State

IF NO PAYMENT IS DUE, DO NOT FILE THIS FORM.

Amount of Payment

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the same

day received by the State. If converted, your check will not be returned. If your check is rejected due to insufficient or uncollected funds,

the Department of Revenue may collect the payment amount directly from your bank account electronically.

(08)

$

.0 0

(Do not write in space below)

1

1