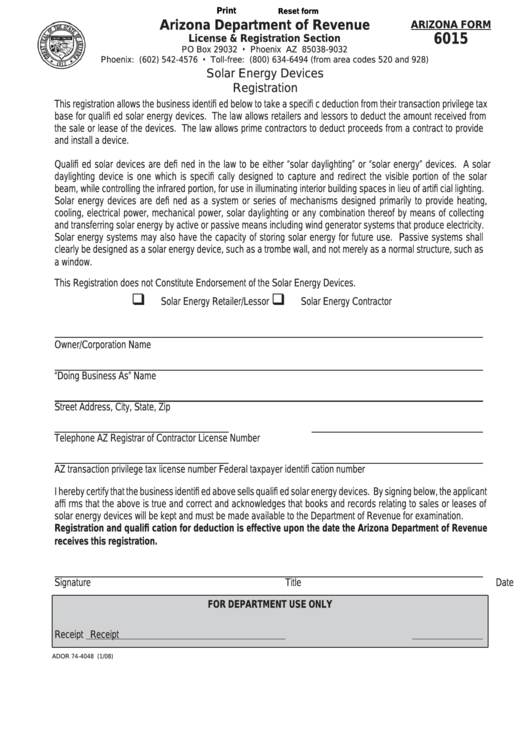

Print

Reset form

Arizona Department of Revenue

ARIZONA FORM

6015

License & Registration Section

PO Box 29032 • Phoenix AZ 85038-9032

Phoenix: (602) 542-4576 • Toll-free: (800) 634-6494 (from area codes 520 and 928)

Solar Energy Devices

Registration

This registration allows the business identifi ed below to take a specifi c deduction from their transaction privilege tax

base for qualifi ed solar energy devices. The law allows retailers and lessors to deduct the amount received from

the sale or lease of the devices. The law allows prime contractors to deduct proceeds from a contract to provide

and install a device.

Qualifi ed solar devices are defi ned in the law to be either “solar daylighting” or “solar energy” devices. A solar

daylighting device is one which is specifi cally designed to capture and redirect the visible portion of the solar

beam, while controlling the infrared portion, for use in illuminating interior building spaces in lieu of artifi cial lighting.

Solar energy devices are defi ned as a system or series of mechanisms designed primarily to provide heating,

cooling, electrical power, mechanical power, solar daylighting or any combination thereof by means of collecting

and transferring solar energy by active or passive means including wind generator systems that produce electricity.

Solar energy systems may also have the capacity of storing solar energy for future use. Passive systems shall

clearly be designed as a solar energy device, such as a trombe wall, and not merely as a normal structure, such as

a window.

This Registration does not Constitute Endorsement of the Solar Energy Devices.

Solar Energy Retailer/Lessor

Solar Energy Contractor

Owner/Corporation Name

“Doing Business As” Name

Street Address, City, State, Zip

Telephone

AZ Registrar of Contractor License Number

AZ transaction privilege tax license number

Federal taxpayer identifi cation number

I hereby certify that the business identifi ed above sells qualifi ed solar energy devices. By signing below, the applicant

affi rms that the above is true and correct and acknowledges that books and records relating to sales or leases of

solar energy devices will be kept and must be made available to the Department of Revenue for examination.

Registration and qualifi cation for deduction is effective upon the date the Arizona Department of Revenue

receives this registration.

Signature

Title

Date

FOR DEPARTMENT USE ONLY

Receipt

Receipt

ADOR 74-4048 (1/08)

1

1