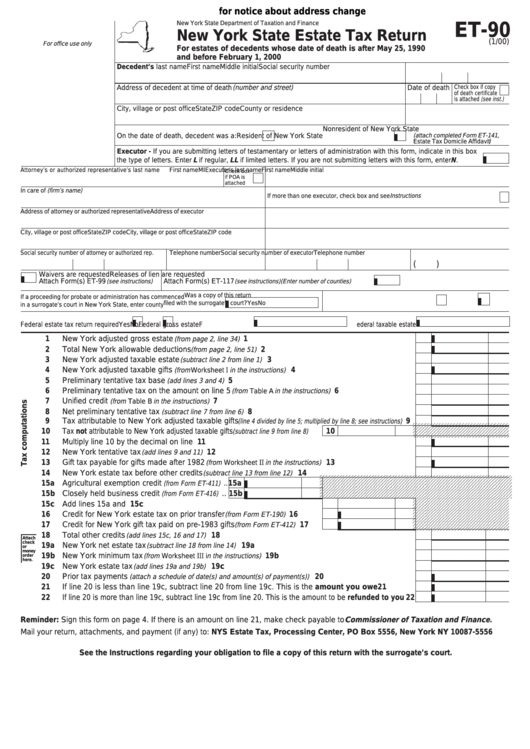

Form Et-90 - New York State Estate Tax Return

ADVERTISEMENT

Click here

for notice about address change

New York State Department of Taxation and Finance

ET-90

New York State Estate Tax Return

(1/00)

For office use only

For estates of decedents whose date of death is after May 25, 1990

and before February 1, 2000

Decedent’s last name

First name

Middle initial

Social security number

Address of decedent at time of death (number and street)

Date of death

Check box if copy

of death certificate

is attached (see inst.)

City, village or post office

State

ZIP code

County or residence

Nonresident of New York State

(attach completed Form ET-141,

On the date of death, decedent was a:

Resident of New York State

Estate Tax Domicile Affidavit )

Executor - If you are submitting letters of testamentary or letters of administration with this form, indicate in this box

the type of letters. Enter L if regular, LL if limited letters. If you are not submitting letters with this form, enter N .

Attorney’s or authorized representative’s last name

First name

MI

Executor’s last name

First name

Middle initial

Check box

if POA is

attached

In care of (firm’s name)

If more than one executor, check box and see Instructions

Address of attorney or authorized representative

Address of executor

City, village or post office

State

ZIP code

City, village or post office

State

ZIP code

Social security number of attorney or authorized rep.

Telephone number

Social security number of executor

Telephone number

(

)

Waivers are requested

Releases of lien are requested

Attach Form(s) ET-99

Attach Form(s) ET-117

(see instructions)

(see instructions)

(Enter number of counties)

Was a copy of this return

If a proceeding for probate or administration has commenced

filed with the surrogate’s court?

Yes

No

in a surrogate’s court in New York State, enter county

Federal estate tax return required

Yes

No

Federal gross estate

Federal taxable estate

1

New York adjusted gross estate

...............................................................................

1

(from page 2, line 34)

2

Total New York allowable deductions

.......................................................................

2

(from page 2, line 51)

3

New York adjusted taxable estate

....................................................................

3

(subtract line 2 from line 1)

4

New York adjusted taxable gifts

.........................................................

4

(from Worksheet I in the instructions)

5

Preliminary tentative tax base

......................................................................................

5

(add lines 3 and 4)

6

Preliminary tentative tax on the amount on line 5

.....................................

6

(from Table A in the instructions)

7

Unified credit

.............................................................................................

7

(from Table B in the instructions)

8

Net preliminary tentative tax

.............................................................................

8

(subtract line 7 from line 6)

9

Tax attributable to New York adjusted taxable gifts

....

9

(line 4 divided by line 5; multiplied by line 8; see instructions)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

10

Tax not attributable to New York adjusted taxable gifts

.... 10

(subtract line 9 from line 8)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

11

Multiply line 10 by the decimal on line 37 ................................................................................................. 11

12

New York tentative tax

................................................................................................ 12

(add lines 9 and 11)

13

Gift tax payable for gifts made after 1982

......................................... 13

(from Worksheet II in the instructions)

14

New York estate tax before other credits

...................................................... 14

(subtract line 13 from line 12)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

15a Agricultural exemption credit

.. 15a

(from Form ET-411)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

15b Closely held business credit

.. 15b

(from Form ET-416)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

15c Add lines 15a and 15b .................................................................................. 15c

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

16

Credit for New York estate tax on prior transfer

..............

16

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

(from Form ET-190)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

17

Credit for New York gift tax paid on pre-1983 gifts

.........

17

(from Form ET-412)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

18

Total other credits

.............................................................................................. 18

(add lines 15c, 16 and 17)

Attach

check

19a New York net estate tax

................................................................................ 19a

(subtract line 18 from line 14)

or

money

19b New York minimum tax

..................................................................... 19b

(from Worksheet III i n the instructions)

order

here.

19c New York estate tax

.............................................................................................. 19c

(add lines 19a and 19b)

20

Prior tax payments

.............................................. 20

(attach a schedule of date(s) and amount(s) of payment(s))

21

If line 20 is less than line 19c, subtract line 20 from line 19c. This is the amount you owe ................ 21

22

If line 20 is more than line 19c, subtract line 19c from line 20. This is the amount to be refunded to you .... 22

Reminder: Sign this form on page 4. If there is an amount on line 21, make check payable to Commissioner of Taxation and Finance.

Mail your return, attachments, and payment (if any) to: NYS Estate Tax, Processing Center, PO Box 5556, New York NY 10087-5556

See the Instructions regarding your obligation to file a copy of this return with the surrogate’s court.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5