Form Dr-16r Draft - Renewal Notice And Application For Sales And Use Tax Direct Pay Permit

ADVERTISEMENT

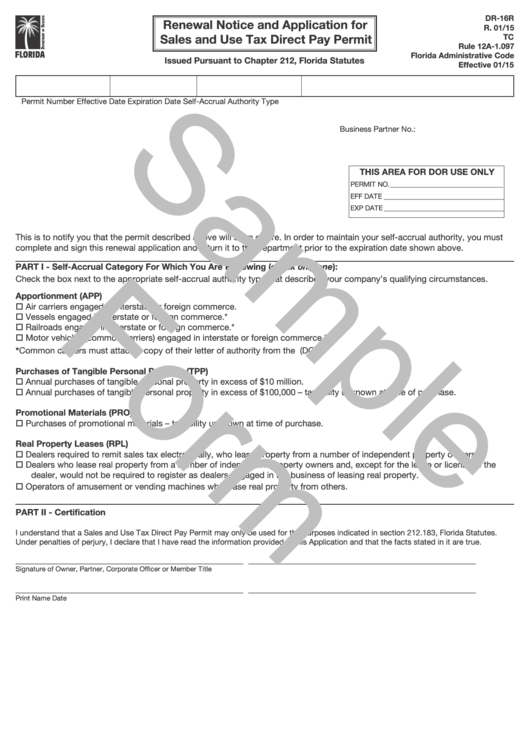

DR-16R

Renewal Notice and Application for

R. 01/15

Sales and Use Tax Direct Pay Permit

TC

Rule 12A-1.097

Florida Administrative Code

Issued Pursuant to Chapter 212, Florida Statutes

Effective 01/15

Permit Number

Effective Date

Expiration Date

Self-Accrual Authority Type

Business Partner No.:

THIS AREA FOR DOR USE ONLY

PERMIT NO. ________________________________

EFF DATE __________________________________

EXP DATE __________________________________

This is to notify you that the permit described above will soon expire. In order to maintain your self-accrual authority, you must

complete and sign this renewal application and return it to the Department prior to the expiration date shown above.

PART I - Self-Accrual Category For Which You Are Renewing (check only one):

Check the box next to the appropriate self-accrual authority type that describes your company’s qualifying circumstances.

Apportionment (APP)

o Air carriers engaged in interstate or foreign commerce.

o Vessels engaged in interstate or foreign commerce.*

o Railroads engaged in interstate or foreign commerce.*

o Motor vehicles (common carriers) engaged in interstate or foreign commerce.*

* Common carriers must attach a copy of their letter of authority from the U.S. Department of Transportation (DOT).

Purchases of Tangible Personal Property (TPP)

o Annual purchases of tangible personal property in excess of $10 million.

o Annual purchases of tangible personal property in excess of $100,000 – taxability unknown at time of purchase.

Promotional Materials (PRO)

o Purchases of promotional materials – taxability unknown at time of purchase.

Real Property Leases (RPL)

o Dealers required to remit sales tax electronically, who lease property from a number of independent property owners.

o Dealers who lease real property from a number of independent property owners and, except for the lease or license to the

dealer, would not be required to register as dealers engaged in the business of leasing real property.

o Operators of amusement or vending machines who lease real property from others.

PART II - Certification

I understand that a Sales and Use Tax Direct Pay Permit may only be used for the purposes indicated in section 212.183, Florida Statutes.

Under penalties of perjury, I declare that I have read the information provided in this Application and that the facts stated in it are true.

____________________________________________________

____________________________________________________

Signature of Owner, Partner, Corporate Officer or Member

Title

____________________________________________________

____________________________________________________

Print Name

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2