Form Dr-16p Draft - Sales And Use Tax Direct Pay Permit

ADVERTISEMENT

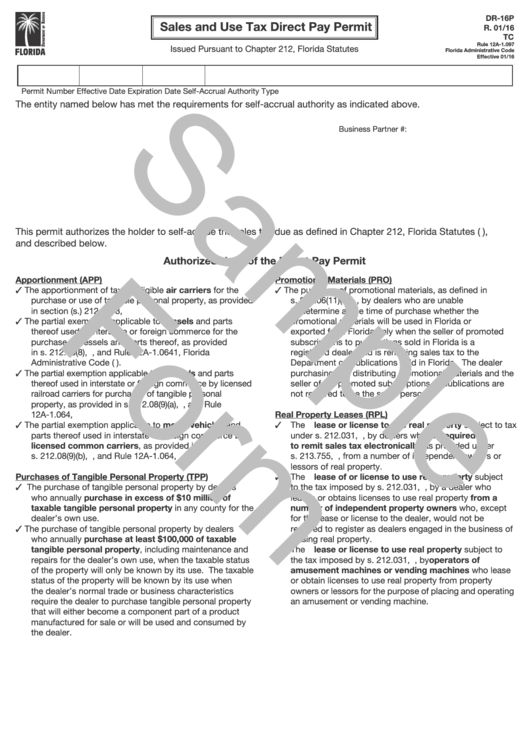

DR-16P

Sales and Use Tax Direct Pay Permit

R. 01/16

TC

Rule 12A-1.097

Issued Pursuant to Chapter 212, Florida Statutes

Florida Administrative Code

Effective 01/16

Permit Number

Effective Date

Expiration Date

Self-Accrual Authority Type

The entity named below has met the requirements for self-accrual authority as indicated above.

Business Partner #:

This permit authorizes the holder to self-accrue the sales tax due as defined in Chapter 212, Florida Statutes (F.S.),

and described below.

Authorized Uses of the Direct Pay Permit

Apportionment (APP)

Promotional Materials (PRO)

3 The apportionment of tax by eligible air carriers for the

3 The purchase of promotional materials, as defined in

purchase or use of tangible personal property, as provided

s. 212.06(11)(b), F.S., by dealers who are unable

in section (s.) 212.0598, F.S.

to determine at the time of purchase whether the

3 The partial exemption applicable to vessels and parts

promotional materials will be used in Florida or

thereof used in interstate or foreign commerce for the

exported from Florida only when the seller of promoted

purchase of vessels and parts thereof, as provided

subscriptions to publications sold in Florida is a

in s. 212.08(8), F.S., and Rule 12A-1.0641, Florida

registered dealer and is remitting sales tax to the

Administrative Code (F.A.C.).

Department on publications sold in Florida. The dealer

3 The partial exemption applicable to railroads and parts

purchasing and distributing promotional materials and the

thereof used in interstate or foreign commerce by licensed

seller of the promoted subscriptions to publications are

railroad carriers for purchases of tangible personal

not required to be the same person.

property, as provided in s. 212.08(9)(a), F.S., and Rule

12A-1.064, F.A.C.

Real Property Leases (RPL)

3 The partial exemption applicable to motor vehicles and

3 The lease or license to use real property subject to tax

parts thereof used in interstate or foreign commerce by

under s. 212.031, F.S., by dealers who are required

licensed common carriers, as provided in

to remit sales tax electronically, as provided under

s. 212.08(9)(b), F.S., and Rule 12A-1.064, F.A.C.

s. 213.755, F.S., from a number of independent owners or

lessors of real property.

Purchases of Tangible Personal Property (TPP)

3 The lease of or license to use real property subject

3 The purchase of tangible personal property by dealers

to the tax imposed by s. 212.031, F.S., by a dealer who

who annually purchase in excess of $10 million of

leases or obtains licenses to use real property from a

taxable tangible personal property in any county for the

number of independent property owners who, except

dealer’s own use.

for the lease or license to the dealer, would not be

3 The purchase of tangible personal property by dealers

required to register as dealers engaged in the business of

who annually purchase at least $100,000 of taxable

leasing real property.

tangible personal property, including maintenance and

3 The lease or license to use real property subject to

repairs for the dealer’s own use, when the taxable status

the tax imposed by s. 212.031, F.S., by operators of

of the property will only be known by its use. The taxable

amusement machines or vending machines who lease

status of the property will be known by its use when

or obtain licenses to use real property from property

the dealer’s normal trade or business characteristics

owners or lessors for the purpose of placing and operating

require the dealer to purchase tangible personal property

an amusement or vending machine.

that will either become a component part of a product

manufactured for sale or will be used and consumed by

the dealer.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2