Reset Form

Print Form

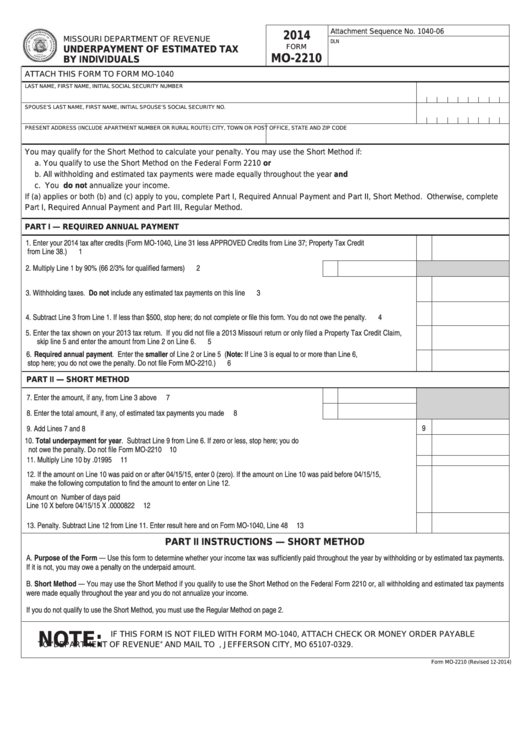

Attachment Sequence No. 1040-06

2014

MISSOURI DEPARTMENT OF REVENUE

DLN

FORM

UNDERPAYMENT OF ESTIMATED TAX

MO-2210

BY INDIVIDUALS

ATTACH THIS FORM TO FORM MO-1040

LAST NAME, FIRST NAME, INITIAL

SOCIAL SECURITY NUMBER

SPOUSE’S LAST NAME, FIRST NAME, INITIAL

SPOUSE’S SOCIAL SECURITY NO.

PRESENT ADDRESS (INCLUDE APARTMENT NUMBER OR RURAL ROUTE)

CITY, TOWN OR POST OFFICE, STATE AND ZIP CODE

You may qualify for the Short Method to calculate your penalty. You may use the Short Method if:

a. You qualify to use the Short Method on the Federal Form 2210 or

b. All withholding and estimated tax payments were made equally throughout the year and

c. You do not annualize your income.

If (a) applies or both (b) and (c) apply to you, complete Part I, Required Annual Payment and Part II, Short Method. Otherwise, complete

Part I, Required Annual Payment and Part III, Regular Method.

PART I — REQUIRED ANNUAL PAYMENT

1. Enter your 2014 tax after credits (Form MO-1040, Line 31 less APPROVED Credits from Line 37; Property Tax Credit

from Line 38.) ...........................................................................................................................................................................................

1

2. Multiply Line 1 by 90% (66 2/3% for qualified farmers) ........................................................................

2

3. Withholding taxes. Do not include any estimated tax payments on this line ..........................................................................................

3

4. Subtract Line 3 from Line 1. If less than $500, stop here; do not complete or file this form. You do not owe the penalty. ......................

4

5. Enter the tax shown on your 2013 tax return. If you did not file a 2013 Missouri return or only filed a Property Tax Credit Claim,

skip line 5 and enter the amount from Line 2 on Line 6. ........................................................................................................................

5

6. Required annual payment. Enter the smaller of Line 2 or Line 5 (Note: If Line 3 is equal to or more than Line 6,

stop here; you do not owe the penalty. Do not file Form MO-2210.) .......................................................................................................

6

PART II — SHORT METHOD

7.

Enter the amount, if any, from Line 3 above ......................................................................................

7

8.

Enter the total amount, if any, of estimated tax payments you made ................................................

8

9

9.

Add Lines 7 and 8 ..................................................................................................................................................................................

10. Total underpayment for year. Subtract Line 9 from Line 6. If zero or less, stop here; you do

not owe the penalty. Do not file Form MO-2210 ....................................................................................................................................

10

11. Multiply Line 10 by .01995 .....................................................................................................................................................................

11

12. If the amount on Line 10 was paid on or after 04/15/15, enter 0 (zero). If the amount on Line 10 was paid before 04/15/15,

make the following computation to find the amount to enter on Line 12.

Amount on

Number of days paid

Line 10

X

before 04/15/15

X

.0000822 ........................................................................

12

13. Penalty. Subtract Line 12 from Line 11. Enter result here and on Form MO-1040, Line 48 ....................................................................

13

PART II INSTRUCTIONS — SHORT METHOD

A. Purpose of the Form — Use this form to determine whether your income tax was sufficiently paid throughout the year by withholding or by estimated tax payments.

If it is not, you may owe a penalty on the underpaid amount.

B. Short Method — You may use the Short Method if you qualify to use the Short Method on the Federal Form 2210 or, all withholding and estimated tax payments

were made equally throughout the year and you do not annualize your income.

If you do not qualify to use the Short Method, you must use the Regular Method on page 2.

NOTE:

IF THIS FORM IS NOT FILED WITH FORM MO-1040, ATTACH CHECK OR MONEY ORDER PAYABLE

TO “DEPARTMENT OF REVENUE” AND MAIL TO P.O. BOX 329, JEFFERSON CITY, MO 65107-0329.

Form MO-2210 (Revised 12-2014)

1

1 2

2 3

3 4

4