Form Rt-800002 - Employer Guide To Reemployment Tax

ADVERTISEMENT

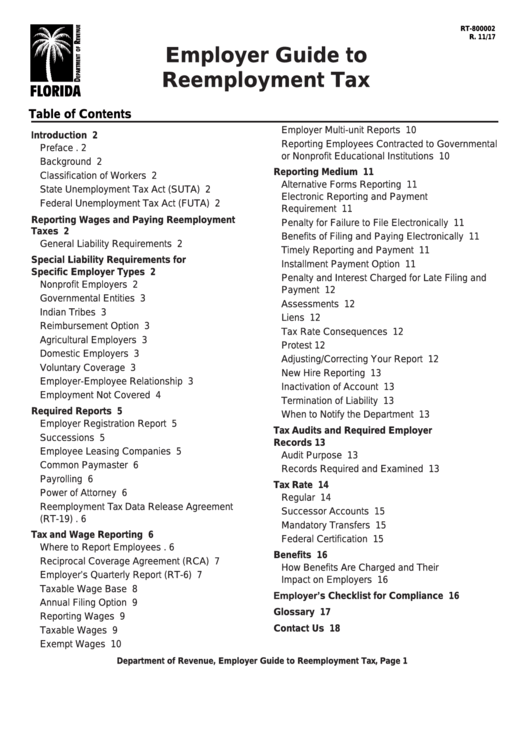

RT-800002

R. 11/17

Employer Guide to

Reemployment Tax

Table of Contents

Employer Multi-unit Reports ............................... 10

Introduction ............................................................ 2

Reporting Employees Contracted to Governmental

Preface ................................................................. 2

or Nonprofit Educational Institutions ................... 10

Background .......................................................... 2

Reporting Medium ............................................... 11

Classification of Workers ....................................... 2

Alternative Forms Reporting ............................... 11

State Unemployment Tax Act (SUTA) .................... 2

Electronic Reporting and Payment

Federal Unemployment Tax Act (FUTA) ................. 2

Requirement ....................................................... 11

Reporting Wages and Paying Reemployment

Penalty for Failure to File Electronically .............. 11

Taxes .................................................................................... 2

Benefits of Filing and Paying Electronically ........ 11

General Liability Requirements ............................. 2

Timely Reporting and Payment .......................... 11

Special Liability Requirements for

Installment Payment Option ............................... 11

Specific Employer Types ............................................ 2

Penalty and Interest Charged for Late Filing and

Nonprofit Employers ............................................. 2

Payment ............................................................ 12

Governmental Entities .......................................... 3

Assessments ..................................................... 12

Indian Tribes ............................................................. 3

Liens .................................................................. 12

Reimbursement Option ......................................... 3

Tax Rate Consequences .................................... 12

Agricultural Employers .......................................... 3

Protest................................................................ 12

Domestic Employers ............................................. 3

Adjusting/Correcting Your Report ....................... 12

Voluntary Coverage .............................................. 3

New Hire Reporting ............................................ 13

Employer-Employee Relationship ......................... 3

Inactivation of Account ....................................... 13

Employment Not Covered ..................................... 4

Termination of Liability ........................................ 13

Required Reports ................................................... 5

When to Notify the Department .......................... 13

Employer Registration Report ............................... 5

Tax Audits and Required Employer

Successions ......................................................... 5

Records................................................................ 13

Employee Leasing Companies ............................. 5

Audit Purpose .................................................... 13

Common Paymaster ............................................. 6

Records Required and Examined ....................... 13

Payrolling .............................................................. 6

Tax Rate ............................................................... 14

Power of Attorney ................................................. 6

Regular .............................................................. 14

Reemployment Tax Data Release Agreement

Successor Accounts ........................................... 15

(RT-19) ................................................................. 6

Mandatory Transfers ............................................ 15

Tax and Wage Reporting ....................................... 6

Federal Certification ........................................... 15

Where to Report Employees ................................. 6

Benefits ................................................................ 16

Reciprocal Coverage Agreement (RCA) ................ 7

How Benefits Are Charged and Their

Employer’s Quarterly Report (RT-6) ...................... 7

Impact on Employers ......................................... 16

Taxable Wage Base .............................................. 8

Employer’s Checklist for Compliance ................ 16

Annual Filing Option ............................................. 9

Glossary .............................................................. 17

Reporting Wages ................................................... 9

Contact Us ........................................................... 18

Taxable Wages ..................................................... 9

Exempt Wages ..................................................... 10

Department of Revenue, Employer Guide to Reemployment Tax, Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18