Instructions For Form Dr-15ez - Sales And Use Tax Returns

ADVERTISEMENT

Instructions for

DR-15EZN

DR-15EZ

R. 01/18

Rule 12A-1.097

Florida Administrative Code

Effective 01/18

Sales and Use Tax Returns

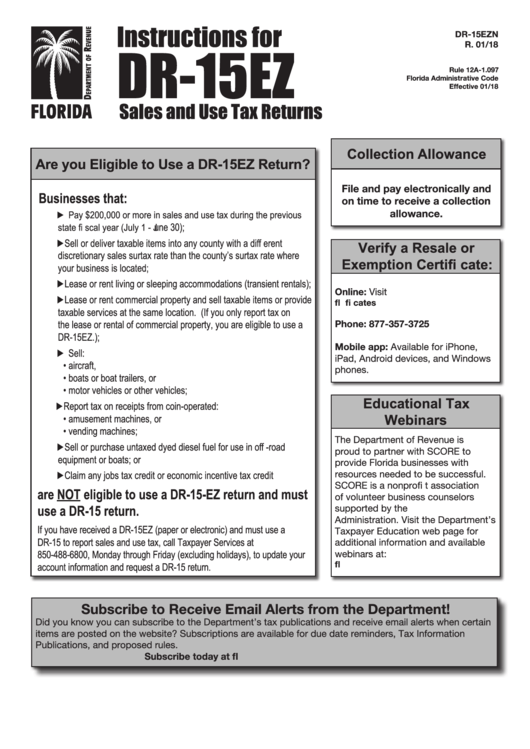

Collection Allowance

Are you Eligible to Use a DR-15EZ Return?

File and pay electronically and

Businesses that:

on time to receive a collection

allowance.

► Pay $200,000 or more in sales and use tax during the previous

une 30);

state fi scal year (July 1 - J

► Sell or deliver taxable items into any county with a diff erent

Verify a Resale or

discretionary sales surtax rate than the county’s surtax rate where

Exemption Certifi cate:

your business is located;

► Lease or rent living or sleeping accommodations (transient rentals);

Online: Visit

► Lease or rent commercial property and sell taxable items or provide

fl cates

taxable services at the same location. (If you only report tax on

the lease or rental of commercial property, you are eligible to use a

Phone: 877-357-3725

DR-15EZ.);

Mobile app: Available for iPhone,

► Sell:

iPad, Android devices, and Windows

• aircraft,

phones.

• boats or boat trailers, or

• motor vehicles or other vehicles;

Educational Tax

► Report tax on receipts from coin-operated:

Webinars

• amusement machines, or

• vending machines;

The Department of Revenue is

► Sell or purchase untaxed dyed diesel fuel for use in off -road

proud to partner with SCORE to

equipment or boats; or

provide Florida businesses with

► Claim any jobs tax credit or economic incentive tax credit

resources needed to be successful.

SCORE is a nonprofi t association

are NOT eligible to use a DR-15-EZ return and must

of volunteer business counselors

use a DR-15 return.

supported by the U.S. Small Business

Administration. Visit the Department’s

If you have received a DR-15EZ (paper or electronic) and must use a

Taxpayer Education web page for

DR-15 to report sales and use tax, call Taxpayer Services at

additional information and available

850- 488-6800, Monday through Friday (excluding holidays), to update your

webinars at:

fl

account information and request a DR-15 return.

Subscribe to Receive Email Alerts from the Department!

Did you know you can subscribe to the Department’s tax publications and receive email alerts when certain

items are posted on the website? Subscriptions are available for due date reminders, Tax Information

Publications, and proposed rules.

Subscribe today at fl

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7