Form Dr-7 Draft - Consolidated Sales And Use Tax Return

ADVERTISEMENT

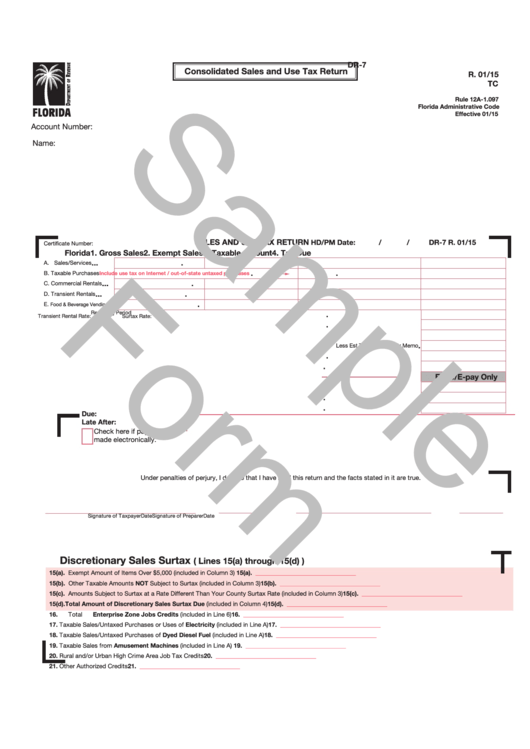

DR-7

Consolidated Sales and Use Tax Return

R. 01/15

TC

Rule 12A-1.097

Florida Administrative Code

Effective 01/15

Account Number:

Name:

SALES AND USE TAX RETURN

-

HD/PM Date:

/

/

DR-7 R. 01/15

Certificate Number:

Florida

1. Gross Sales

2. Exempt Sales

3. Taxable Amount

4. Tax Due

XXXXXXXXXX-X

.

.

.

.

A. Sales/Services

.

.

B. Taxable Purchases

Include use tax on Internet / out-of-state untaxed purchases

.

.

.

.

C. Commercial Rentals

.

.

.

.

D. Transient Rentals

.

.

.

.

E.

Food & Beverage Vending

Reporting Period

.

5. Total Amount of Tax Due

Transient Rental Rate:

Surtax Rate:

.

6. Less Lawful Deductions

.

7. Net Tax Due

.

8. Less Est Tax Pd / DOR Cr Memo

.

9. Plus Est Tax Due Current Month

.

10. Amount Due

E-file/E-pay Only

11. Less Collection Allowance

.

12. Plus Penalty

.

13. Plus Interest

.

14. Amount Due with Return

Due:

Late After:

Check here if payment was

made electronically.

Under penalties of perjury, I declare that I have read this return and the facts stated in it are true.

Signature of Taxpayer

Date

Signature of Preparer

Date

Discretionary Sales Surtax

( Lines 15(a) through 15(d) )

15(a). Exempt Amount of Items Over $5,000 (included in Column 3) ............................................................................................ 15(a).

_________________________________

15(b). Other Taxable Amounts NOT Subject to Surtax (included in Column 3) .............................................................................. 15(b).

_________________________________

15(c). Amounts Subject to Surtax at a Rate Different Than Your County Surtax Rate (included in Column 3) .............................. 15(c).

_________________________________

15(d). Total Amount of Discretionary Sales Surtax Due (included in Column 4) ........................................................................ 15(d).

_________________________________

16.

Total Enterprise Zone Jobs Credits (included in Line 6) ........................................................................................................ 16.

_________________________________

17.

Taxable Sales/Untaxed Purchases or Uses of Electricity (included in Line A) ........................................................................ 17.

_________________________________

18.

Taxable Sales/Untaxed Purchases of Dyed Diesel Fuel (included in Line A) .......................................................................... 18.

_________________________________

19.

Taxable Sales from Amusement Machines (included in Line A) ............................................................................................ 19.

_________________________________

20.

Rural and/or Urban High Crime Area Job Tax Credits .............................................................................................................. 20.

_________________________________

21.

Other Authorized Credits .......................................................................................................................................................... 21.

_________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4