Reset Form

Print Form

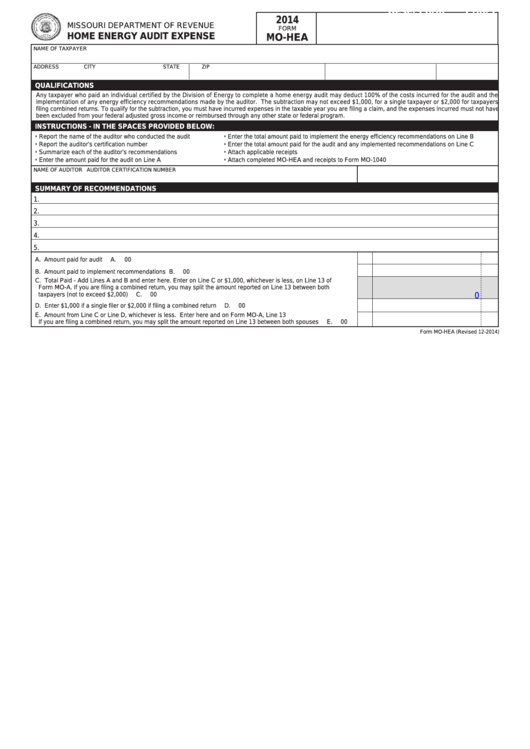

2014

MISSOURI DEPARTMENT OF REVENUE

FORM

HOME ENERGY AUDIT EXPENSE

MO-HEA

NAME OF TAXPAYER

ADDRESS

CITY

STATE

ZIP

QUALIFICATIONS

Any taxpayer who paid an individual certified by the Division of Energy to complete a home energy audit may deduct 100% of the costs incurred for the audit and the

implementation of any energy efficiency recommendations made by the auditor. The subtraction may not exceed $1,000, for a single taxpayer or $2,000 for taxpayers

filing combined returns. To qualify for the subtraction, you must have incurred expenses in the taxable year you are filing a claim, and the expenses incurred must not have

been excluded from your federal adjusted gross income or reimbursed through any other state or federal program.

INSTRUCTIONS - IN THE SPACES PROVIDED BELOW:

• Report the name of the auditor who conducted the audit

• Enter the total amount paid to implement the energy efficiency recommendations on Line B

• Report the auditor’s certification number

• Enter the total amount paid for the audit and any implemented recommendations on Line C

• Summarize each of the auditor’s recommendations

• Attach applicable receipts

• Enter the amount paid for the audit on Line A

• Attach completed MO-HEA and receipts to Form MO-1040

NAME OF AUDITOR

AUDITOR CERTIFICATION NUMBER

SUMMARY OF RECOMMENDATIONS

1.

2.

3.

4.

5.

A. Amount paid for audit .....................................................................................................................................................

A.

00

B. Amount paid to implement recommendations ...............................................................................................................

B.

00

C. Total Paid - Add Lines A and B and enter here. Enter on Line C or $1,000, whichever is less, on Line 13 of

Form MO-A. If you are filing a combined return, you may split the amount reported on Line 13 between both

0

taxpayers (not to exceed $2,000) ...................................................................................................................................

C.

00

D. Enter $1,000 if a single filer or $2,000 if filing a combined return ..................................................................................

D.

00

E. Amount from Line C or Line D, whichever is less. Enter here and on Form MO-A, Line 13

If you are filing a combined return, you may split the amount reported on Line 13 between both spouses ...................

E.

00

Form MO-HEA (Revised 12-2014)

1

1