Reset Form

Print Form

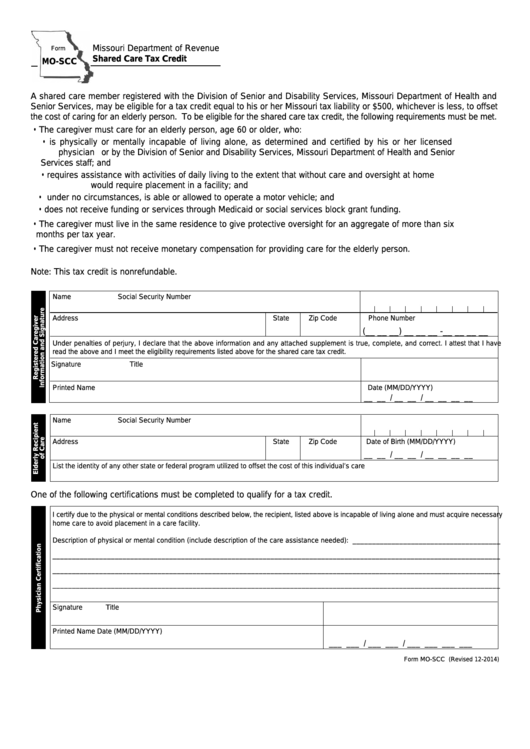

Missouri Department of Revenue

Form

Shared Care Tax Credit

MO-SCC

A shared care member registered with the Division of Senior and Disability Services, Missouri Department of Health and

Senior Services, may be eligible for a tax credit equal to his or her Missouri tax liability or $500, whichever is less, to offset

the cost of caring for an elderly person. To be eligible for the shared care tax credit, the following requirements must be met.

• The caregiver must care for an elderly person, age 60 or older, who:

• is physically or mentally incapable of living alone, as determined and certified by his or her licensed

physician or by the Division of Senior and Disability Services, Missouri Department of Health and Senior

Services staff; and

• requires assistance with activities of daily living to the extent that without care and oversight at home

would require placement in a facility; and

• under no circumstances, is able or allowed to operate a motor vehicle; and

• does not receive funding or services through Medicaid or social services block grant funding.

• The caregiver must live in the same residence to give protective oversight for an aggregate of more than six

months per tax year.

• The caregiver must not receive monetary compensation for providing care for the elderly person.

Note: This tax credit is nonrefundable.

Name

Social Security Number

Address

State

Zip Code

Phone Number

(__ __ __) __ __ __ -__ __ __ __

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct. I attest that I have

read the above and I meet the eligibility requirements listed above for the shared care tax credit.

Signature

Title

Printed Name

Date (MM/DD/YYYY)

__ __ / __ __ / __ __ __ __

Name

Social Security Number

Address

State

Zip Code

Date of Birth (MM/DD/YYYY)

__ __ / __ __ / __ __ __ __

List the identity of any other state or federal program utilized to offset the cost of this individual’s care

One of the following certifications must be completed to qualify for a tax credit.

I certify due to the physical or mental conditions described below, the recipient, listed above is incapable of living alone and must acquire necessary

home care to avoid placement in a care facility.

Description of physical or mental condition (include description of the care assistance needed): ______________________________________

___________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________

Signature

Title

Printed Name

Date (MM/DD/YYYY)

___ ___ / ___ ___ / ___ ___ ___ ___

Form MO-SCC (Revised 12-2014)

1

1 2

2