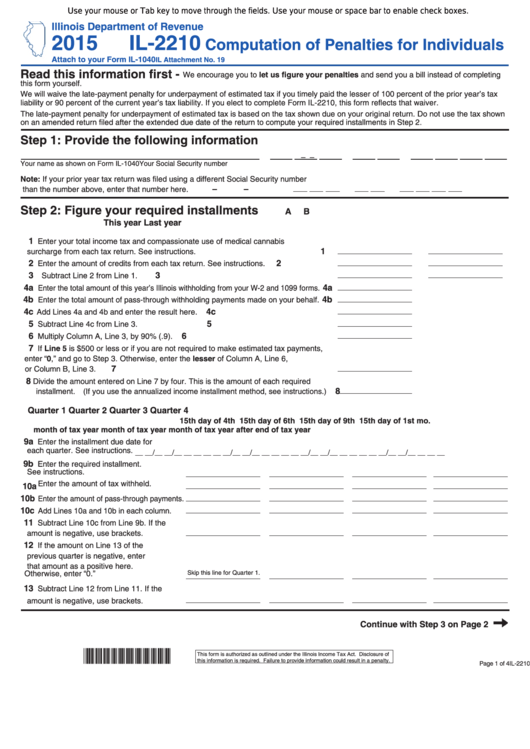

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

2015 IL-2210

Computation of Penalties for Individuals

Attach to your Form IL-1040

IL Attachment No. 19

Read this information first -

We encourage you to let us figure your penalties and send you a bill instead of completing

this form yourself.

We will waive the late-payment penalty for underpayment of estimated tax if you timely paid the lesser of 100 percent of the prior year’s tax

liability or 90 percent of the current year’s tax liability. If you elect to complete Form IL-2210, this form reflects that waiver.

The late-payment penalty for underpayment of estimated tax is based on the tax shown due on your original return. Do not use the tax shown

on an amended return filed after the extended due date of the return to compute your required installments in Step 2.

Step 1: Provide the following information

–

–

Your name as shown on Form IL-1040

Your Social Security number

Note: If your prior year tax return was filed using a different Social Security number

–

–

than the number above, enter that number here.

Step 2: Figure your required installments

A

B

This year

Last year

1

Enter your total income tax and compassionate use of medical cannabis

1

surcharge from each tax return. See instructions.

2

2

Enter the amount of credits from each tax return. See instructions.

3

3

Subtract Line 2 from Line 1.

4a

4a

Enter the total amount of this year’s Illinois withholding from your W-2 and 1099 forms.

4b

4b

Enter the total amount of pass-through withholding payments made on your behalf.

4c

4c

Add Lines 4a and 4b and enter the result here.

5

5

Subtract Line 4c from Line 3.

6

6

Multiply Column A, Line 3, by 90% (.9).

7

If Line 5 is $500 or less or if you are not required to make estimated tax payments,

enter “0,” and go to Step 3. Otherwise, enter the lesser of Column A, Line 6,

7

or Column B, Line 3.

8

Divide the amount entered on Line 7 by four. This is the amount of each required

8

installment. (If you use the annualized income installment method, see instructions.)

Quarter 1

Quarter 2

Quarter 3

Quarter 4

15th day of 4th

15th day of 6th

15th day of 9th

15th day of 1st mo.

month of tax year

month of tax year

month of tax year

after end of tax year

9a

Enter the installment due date for

each quarter. See instructions.

__ __/__ __/__ __ __ __

__ __/__ __/__ __ __ __

__ __/__ __/__ __ __ __ __ __/__ __/__ __ __ __

9b

Enter the required installment.

See instructions.

10a

Enter the amount of tax withheld.

10b

Enter the amount of pass-through payments.

10c

Add Lines 10a and 10b in each column.

11

Subtract Line 10c from Line 9b. If the

amount is negative, use brackets.

12

If the amount on Line 13 of the

previous quarter is negative, enter

that amount as a positive here.

Skip this line for Quarter 1.

Otherwise, enter “0.”

13

Subtract Line 12 from Line 11. If the

amount is negative, use brackets.

Continue with Step 3 on Page 2

*561701110*

This form is authorized as outlined under the Illinois Income Tax Act. Disclosure of

this information is required. Failure to provide information could result in a penalty.

IL-2210 (R-12/15)

Page 1 of 4

1

1 2

2 3

3 4

4