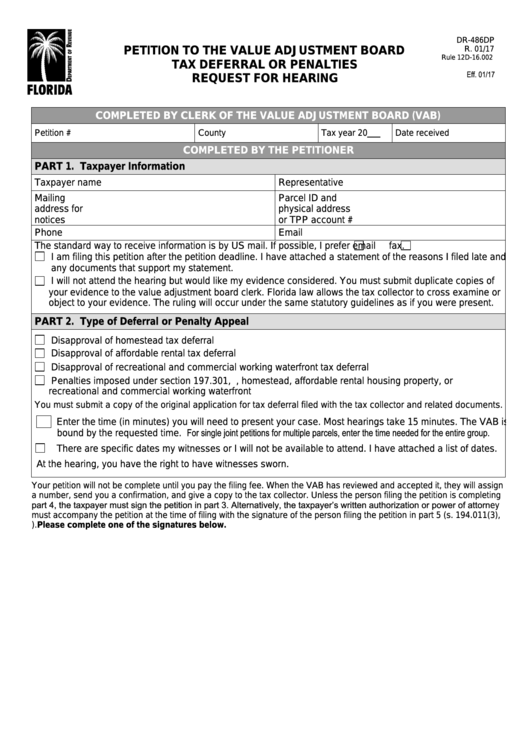

DR-486DP

PETITION TO THE VALUE ADJUSTMENT BOARD

R. 01/17

Rule 12D-16.002

TAX DEFERRAL OR PENALTIES

F.A.C.

Eff. 01/17

REQUEST FOR HEARING

COMPLETED BY CLERK OF THE VALUE ADJUSTMENT BOARD (VAB)

Petition #

County

Tax year 20

Date received

COMPLETED BY THE PETITIONER

PART 1. Taxpayer Information

Taxpayer name

Representative

Mailing

Parcel ID and

address for

physical address

notices

or TPP account #

Phone

Email

The standard way to receive information is by US mail. If possible, I prefer

email

fax.

I am filing this petition after the petition deadline. I have attached a statement of the reasons I filed late and

any documents that support my statement.

I will not attend the hearing but would like my evidence considered. You must submit duplicate copies of

your evidence to the value adjustment board clerk. Florida law allows the tax collector to cross examine or

object to your evidence. The ruling will occur under the same statutory guidelines as if you were present.

PART 2. Type of Deferral or Penalty Appeal

Disapproval of homestead tax deferral

Disapproval of affordable rental tax deferral

Disapproval of recreational and commercial working waterfront tax deferral

Penalties imposed under section 197.301, F.S., homestead, affordable rental housing property, or

recreational and commercial working waterfront

You must submit a copy of the original application for tax deferral filed with the tax collector and related documents.

Enter the time (in minutes) you will need to present your case. Most hearings take 15 minutes. The VAB is not

bound by the requested time. For single joint petitions for multiple parcels, enter the time needed for the entire group.

There are specific dates my witnesses or I will not be available to attend. I have attached a list of dates.

At the hearing, you have the right to have witnesses sworn.

Your petition will not be complete until you pay the filing fee. When the VAB has reviewed and accepted it, they will assign

a number, send you a confirmation, and give a copy to the tax collector. Unless the person filing the petition is completing

part 4, the taxpayer must sign the petition in part 3. Alternatively, the taxpayer’s written authorization or power of attorney

must accompany the petition at the time of filing with the signature of the person filing the petition in part 5 (s. 194.011(3),

F.S.). Please complete one of the signatures below.

1

1 2

2