Commercial Forestry Excise Tax Return Schedule - Maine Revenue Services Property Tax Division

ADVERTISEMENT

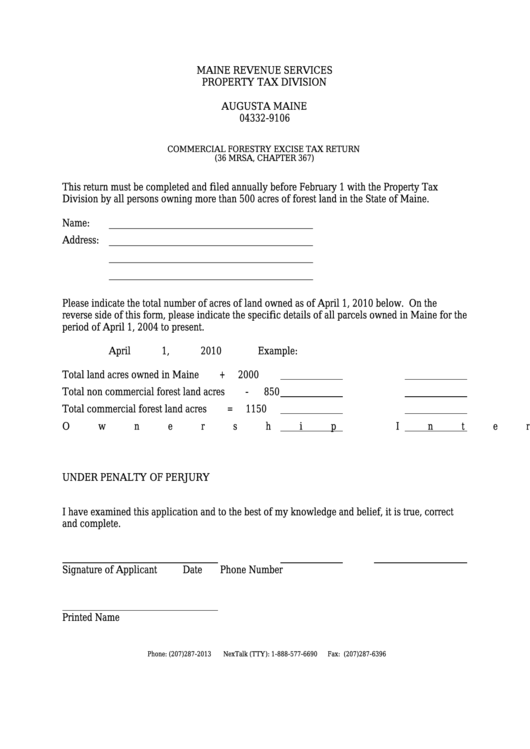

MAINE REVENUE SERVICES

PROPERTY TAX DIVISION

P.O. BOX 9106

AUGUSTA MAINE

04332-9106

COMMERCIAL FORESTRY EXCISE TAX RETURN

(36 MRSA, CHAPTER 367)

This return must be completed and filed annually before February 1 with the Property Tax

Division by all persons owning more than 500 acres of forest land in the State of Maine.

Name:

_______________________________________

Address: _______________________________________

_______________________________________

_______________________________________

Please indicate the total number of acres of land owned as of April 1, 2010 below. On the

reverse side of this form, please indicate the specific details of all parcels owned in Maine for the

period of April 1, 2004 to present.

April 1, 2010

Example:

Total land acres owned in Maine

+

2000

Total non commercial forest land acres

-

850

Total commercial forest land acres

=

1150

Ownership Interest

100%

UNDER PENALTY OF PERJURY

I have examined this application and to the best of my knowledge and belief, it is true, correct

and complete.

Signature of Applicant

Date

Phone Number

Printed Name

Phone: (207)287-2013

NexTalk (TTY): 1-888-577-6690

Fax: (207)287-6396

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2