1399

201399

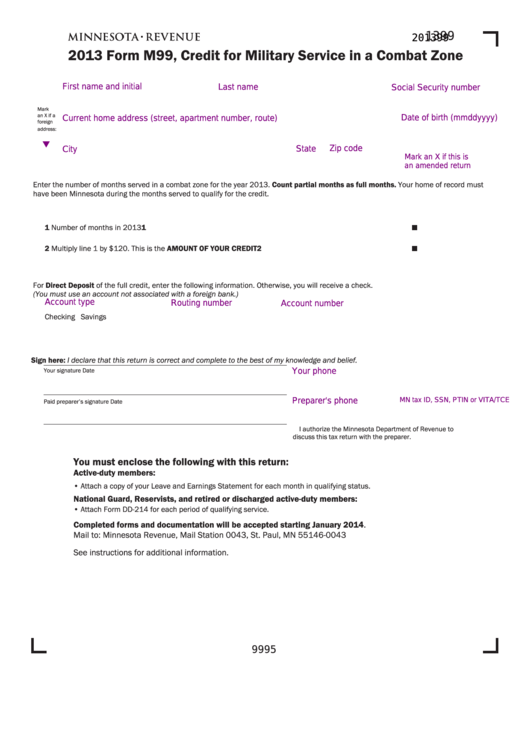

2013 Form M99, Credit for Military Service in a Combat Zone

First name and initial

Last name

Social Security number

Mark

an X if a

Current home address (street, apartment number, route)

Date of birth (mmddyyyy)

foreign

address:

▼

State

Zip code

City

Mark an X if this is

an amended return

Enter the number of months served in a combat zone for the year 2013. Count partial months as full months. Your home of record must

have been Minnesota during the months served to qualify for the credit.

1 Number of months in 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1

2 Multiply line 1 by $120. This is the AMOUNT OF YOUR CREDIT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2

For Direct Deposit of the full credit, enter the following information. Otherwise, you will receive a check.

(You must use an account not associated with a foreign bank.)

Account type

Routing number

Account number

Checking

Savings

Sign here: I declare that this return is correct and complete to the best of my knowledge and belief.

Your signature

Date

Your phone

Preparer's phone

MN tax ID, SSN, PTIN or VITA/TCE

Paid preparer’s signature

Date

I authorize the Minnesota Department of Revenue to

discuss this tax return with the preparer.

You must enclose the following with this return:

Active-duty members:

• Attach a copy of your Leave and Earnings Statement for each month in qualifying status.

National Guard, Reservists, and retired or discharged active-duty members:

• Attach Form DD-214 for each period of qualifying service.

Completed forms and documentation will be accepted starting January 2014.

Mail to: Minnesota Revenue, Mail Station 0043, St. Paul, MN 55146-0043

See instructions for additional information.

9995

1

1 2

2 3

3