Form Dr-700033 - Notification Of Alternative-Period Basis Reporting For Communications Services Tax

ADVERTISEMENT

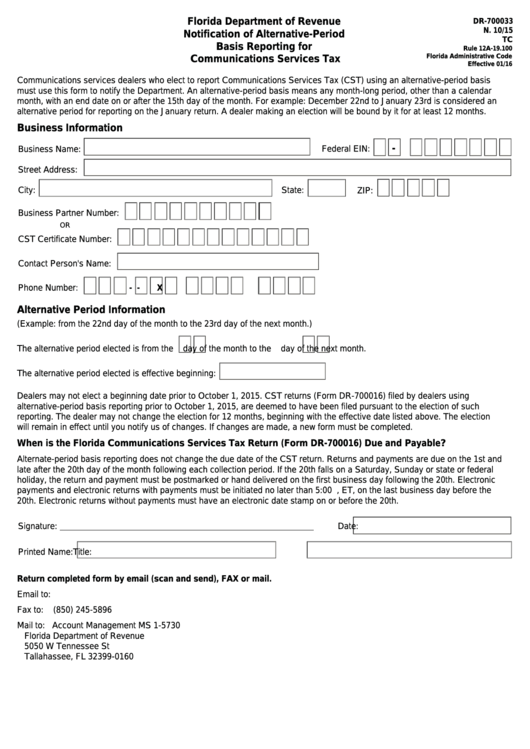

Florida Department of Revenue

DR-700033

N. 10/15

Notification of Alternative-Period

TC

Basis Reporting for

Rule 12A-19.100

Florida Administrative Code

Communications Services Tax

Effective 01/16

Communications services dealers who elect to report Communications Services Tax (CST) using an alternative-period basis

must use this form to notify the Department. An alternative-period basis means any month-long period, other than a calendar

month, with an end date on or after the 15th day of the month. For example: December 22nd to January 23rd is considered an

alternative period for reporting on the January return. A dealer making an election will be bound by it for at least 12 months.

Business Information

-

Business Name:

Federal EIN:

Street Address:

City:

State:

ZIP:

Business Partner Number:

OR

CST Certificate Number:

Contact Person's Name:

Phone Number:

-

-

X

Alternative Period Information

(Example: from the 22nd day of the month to the 23rd day of the next month.)

The alternative period elected is from the

day of the month to the

day of the next month.

The alternative period elected is effective beginning:

Dealers may not elect a beginning date prior to October 1, 2015. CST returns (Form DR-700016) filed by dealers using

alternative-period basis reporting prior to October 1, 2015, are deemed to have been filed pursuant to the election of such

reporting. The dealer may not change the election for 12 months, beginning with the effective date listed above. The election

will remain in effect until you notify us of changes. If changes are made, a new form must be completed.

When is the Florida Communications Services Tax Return (Form DR-700016) Due and Payable?

Alternate-period basis reporting does not change the due date of the CST return. Returns and payments are due on the 1st and

late after the 20th day of the month following each collection period. If the 20th falls on a Saturday, Sunday or state or federal

holiday, the return and payment must be postmarked or hand delivered on the first business day following the 20th. Electronic

payments and electronic returns with payments must be initiated no later than 5:00 p.m., ET, on the last business day before the

20th. Electronic returns without payments must have an electronic date stamp on or before the 20th.

Signature:

Date:

Printed Name:

Title:

Return completed form by email (scan and send), FAX or mail.

Email to:

Fax to:

(850) 245-5896

Mail to: Account Management MS 1-5730

Florida Department of Revenue

5050 W Tennessee St

Tallahassee, FL 32399-0160

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2