Form Dr-700019 - Communications Services Use Tax Return

ADVERTISEMENT

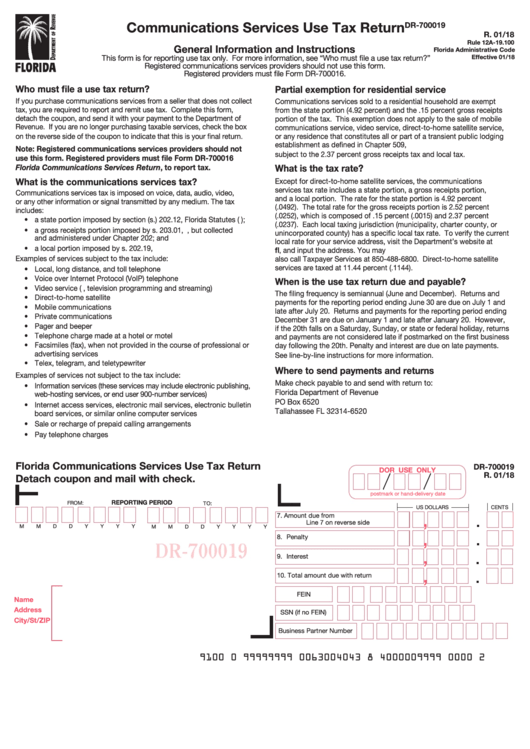

Communications Services Use Tax Return

DR-700019

R. 01/18

Rule 12A-19.100

General Information and Instructions

Florida Administrative Code

This form is for reporting use tax only. For more information, see “Who must file a use tax return?”

Effective 01/18

Registered communications services providers should not use this form.

Registered providers must file Form DR-700016.

Who must file a use tax return?

Partial exemption for residential service

If you purchase communications services from a seller that does not collect

Communications services sold to a residential household are exempt

tax, you are required to report and remit use tax. Complete this form,

from the state portion (4.92 percent) and the .15 percent gross receipts

detach the coupon, and send it with your payment to the Department of

portion of the tax. This exemption does not apply to the sale of mobile

Revenue. If you are no longer purchasing taxable services, check the box

communications service, video service, direct-to-home satellite service,

on the reverse side of the coupon to indicate that this is your final return.

or any residence that constitutes all or part of a transient public lodging

establishment as defined in Chapter 509, F.S. Residential service is

Note: Registered communications services providers should not

subject to the 2.37 percent gross receipts tax and local tax.

use this form. Registered providers must file Form DR-700016

What is the tax rate?

Florida Communications Services Return, to report tax.

What is the communications services tax?

Except for direct-to-home satellite services, the communications

services tax rate includes a state portion, a gross receipts portion,

Communications services tax is imposed on voice, data, audio, video,

and a local portion. The rate for the state portion is 4.92 percent

or any other information or signal transmitted by any medium. The tax

(.0492). The total rate for the gross receipts portion is 2.52 percent

includes:

(.0252), which is composed of .15 percent (.0015) and 2.37 percent

• a state portion imposed by section (s.) 202.12, Florida Statutes (F.S.);

(.0237). Each local taxing jurisdiction (municipality, charter county, or

• a gross receipts portion imposed by s. 203.01, F.S., but collected

unincorporated county) has a specific local tax rate. To verify the current

and administered under Chapter 202; and

local rate for your service address, visit the Department’s website at

• a local portion imposed by s. 202.19, F.S.

, and input the address. You may

Examples of services subject to the tax include:

also call Taxpayer Services at 850-488-6800. Direct-to-home satellite

services are taxed at 11.44 percent (.1144).

• Local, long distance, and toll telephone

• Voice over Internet Protocol (VoIP) telephone

When is the use tax return due and payable?

• Video service (e.g., television programming and streaming)

The filing frequency is semiannual (June and December). Returns and

• Direct-to-home satellite

payments for the reporting period ending June 30 are due on July 1 and

• Mobile communications

late after July 20. Returns and payments for the reporting period ending

• Private communications

December 31 are due on January 1 and late after January 20. However,

• Pager and beeper

if the 20th falls on a Saturday, Sunday, or state or federal holiday, returns

• Telephone charge made at a hotel or motel

and payments are not considered late if postmarked on the first business

• Facsimiles (fax), when not provided in the course of professional or

day following the 20th. Penalty and interest are due on late payments.

advertising services

See line-by-line instructions for more information.

• Telex, telegram, and teletypewriter

Where to send payments and returns

Examples of services not subject to the tax include:

Make check payable to and send with return to:

• Information services (these services may include electronic publishing,

Florida Department of Revenue

web-hosting services, or end user 900-number services)

PO Box 6520

• Internet access services, electronic mail services, electronic bulletin

Tallahassee FL 32314-6520

board services, or similar online computer services

• Sale or recharge of prepaid calling arrangements

• Pay telephone charges

Florida Communications Services Use Tax Return

DR-700019

DOR USE ONLY

R. 01/18

Detach coupon and mail with check.

postmark or hand-delivery date

REPORTING PERIOD

FROM:

TO:

US DOLLARS

CENTS

,

7. Amount due from

Line 7 on reverse side

M

M

D

D

Y

Y

Y

Y

M

M

D

D

Y

Y

Y

Y

,

8. Penalty

,

9. Interest

,

10. Total amount due with return

FEIN

Name

Address

SSN (if no FEIN)

City/St/ZIP

Business Partner Number

9100 0 99999999 0063004043 8 4000009999 0000 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2