Form Dr-55 - Application For Compensation For Tax Information

ADVERTISEMENT

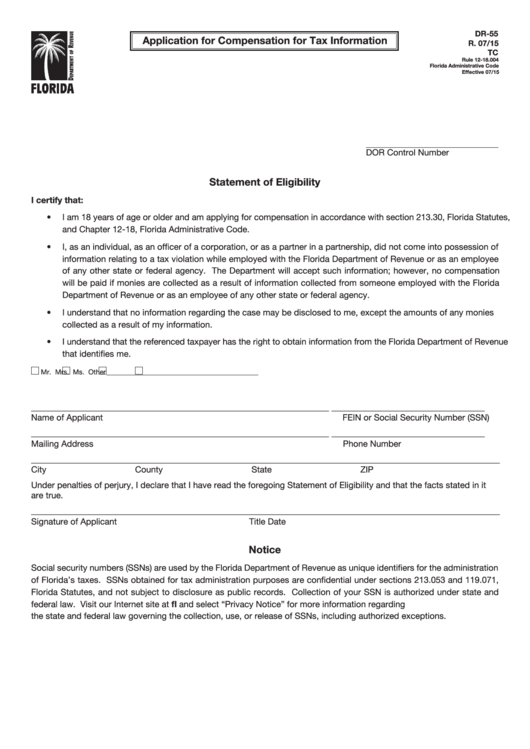

DR-55

Application for Compensation for Tax Information

R. 07/15

TC

Rule 12-18.004

Florida Administrative Code

Effective 07/15

DOR Control Number

Statement of Eligibility

I certify that:

• I am 18 years of age or older and am applying for compensation in accordance with section 213.30, Florida Statutes,

and Chapter 12-18, Florida Administrative Code.

• I, as an individual, as an officer of a corporation, or as a partner in a partnership, did not come into possession of

information relating to a tax violation while employed with the Florida Department of Revenue or as an employee

of any other state or federal agency. The Department will accept such information; however, no compensation

will be paid if monies are collected as a result of information collected from someone employed with the Florida

Department of Revenue or as an employee of any other state or federal agency.

• I understand that no information regarding the case may be disclosed to me, except the amounts of any monies

collected as a result of my information.

• I understand that the referenced taxpayer has the right to obtain information from the Florida Department of Revenue

that identifies me.

Mr.

Mrs.

Ms.

Other ___________________________________________

____________________________________________________________________

___________________________________

Name of Applicant

FEIN or Social Security Number (SSN)

____________________________________________________________________

___________________________________

Mailing Address

Phone Number

___________________________________________________________________________________________________________

City

County

State

ZIP

Under penalties of perjury, I declare that I have read the foregoing Statement of Eligibility and that the facts stated in it

are true.

___________________________________________________________________________________________________________

Signature of Applicant

Title

Date

Notice

Social security numbers (SSNs) are used by the Florida Department of Revenue as unique identifiers for the administration

of Florida’s taxes. SSNs obtained for tax administration purposes are confidential under sections 213.053 and 119.071,

Florida Statutes, and not subject to disclosure as public records. Collection of your SSN is authorized under state and

federal law. Visit our Internet site at and select “Privacy Notice” for more information regarding

the state and federal law governing the collection, use, or release of SSNs, including authorized exceptions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3