Form Dr-160 Draft - Application For Fuel Tax Refund Mass Transit System Users

ADVERTISEMENT

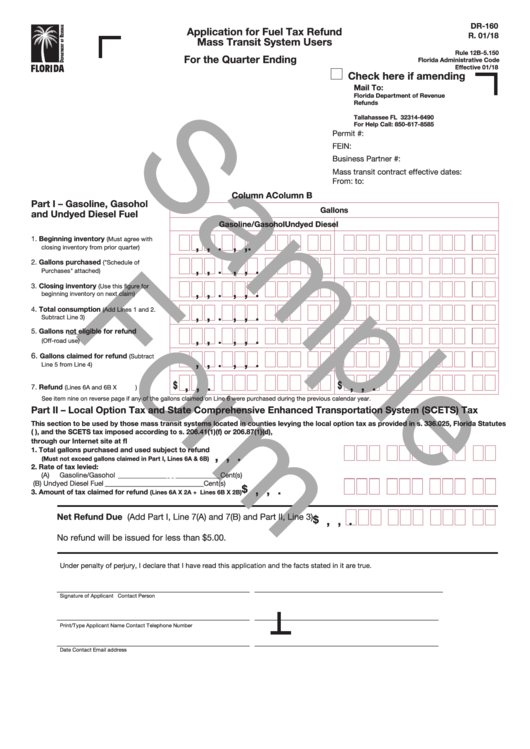

DR-160

Application for Fuel Tax Refund

R. 01/18

Mass Transit System Users

Rule 12B-5.150

For the Quarter Ending

Florida Administrative Code

Effective 01/18

Check here if amending

Mail To:

Florida Department of Revenue

Refunds

P.O. Box 6490

Tallahassee FL 32314-6490

For Help Call: 850-617-8585

Permit #:

FEIN:

Business Partner #:

Mass transit contract effective dates:

From:

to:

Column A

Column B

Part I – Gasoline, Gasohol

Gallons

and Undyed Diesel Fuel

Gasoline/Gasohol

Undyed Diesel

1. Beginning inventory

(Must agree with

,

,

.

,

,

.

closing inventory from prior quarter) ................

2. Gallons purchased

("Schedule of

,

,

.

,

,

.

Purchases" attached) .......................................

3. Closing inventory

(Use this figure for

,

,

.

,

,

.

beginning inventory on next claim) ..................

4. Total consumption

(Add Lines 1 and 2.

,

,

.

,

,

.

Subtract Line 3) ................................................

5. Gallons not eligible for refund

,

,

.

,

,

.

(Off-road use) ...................................................

6.

Gallons claimed for refund

(Subtract

,

,

.

,

,

.

Line 5 from Line 4) ............................................

$

,

,

.

$

,

,

.

7. Refund

(Lines 6A and 6B X

.1331

) ................

See item nine on reverse page if any of the gallons claimed on Line 6 were purchased during the previous calendar year.

Part II – Local Option Tax and State Comprehensive Enhanced Transportation System (SCETS) Tax

This section to be used by those mass transit systems located in counties levying the local option tax as provided in s. 336.025, Florida Statutes

(F.S.), and the SCETS tax imposed according to s. 206.41(1)(f) or 206.87(1)(d), F.S. Current local option and SCETS tax rates are available

through our Internet site at .

1. Total gallons purchased and used subject to refund

,

,

.

(Must not exceed gallons claimed in Part I, Lines 6A & 6B) ................................................................................

2. Rate of tax levied:

(A)

Gasoline/Gasohol _____________________________Cent(s)

.132

(B)

Undyed Diesel Fuel ____________________________Cent(s)

$

,

,

.

3. Amount of tax claimed for refund

(Lines 6A X 2A + Lines 6B X 2B) .....................................................

Net Refund Due (Add Part I, Line 7(A) and 7(B) and Part II, Line 3)

$

,

,

.

No refund will be issued for less than $5.00.

Under penalty of perjury, I declare that I have read this application and the facts stated in it are true.

____________________________________________

___________________________________________

Signature of Applicant

Contact Person

____________________________________________

__________________________________________

Print/Type Applicant Name

Contact Telephone Number

____________________________________________

__________________________________________

Date

Contact Email address

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3