MARYLAND SUSTAINABLE

FORM

2012

502S

COMMUNITIES TAX CREDIT

For applications received by Maryland Historical Trust on or after June 1, 2010

Name of taxpayer(s)

Taxpayer Identification Number

Check here if this credit is derived from an entity other than that shown above.

Enter the entity’s federal employer identification number. If from more than one entity, attach schedule.

FEIN

YOUR MARYLAND RESTORATION AND QUALIFIED COSTS MUST BE CERTIFIED BY THE MARYLAND HISTORICAL TRUST (MHT)

Attach a copy of your approved Certification Application (Part 3) and Form 502S to your tax return.

REMINDER: Do not send photographs to the Revenue Administration Division. All photographs are to be sent to the MHT at:

100 Community Place, Crownsville, Maryland 21032-2023.

For further information or to obtain applications, contact the MHT at 410-514-7628 or

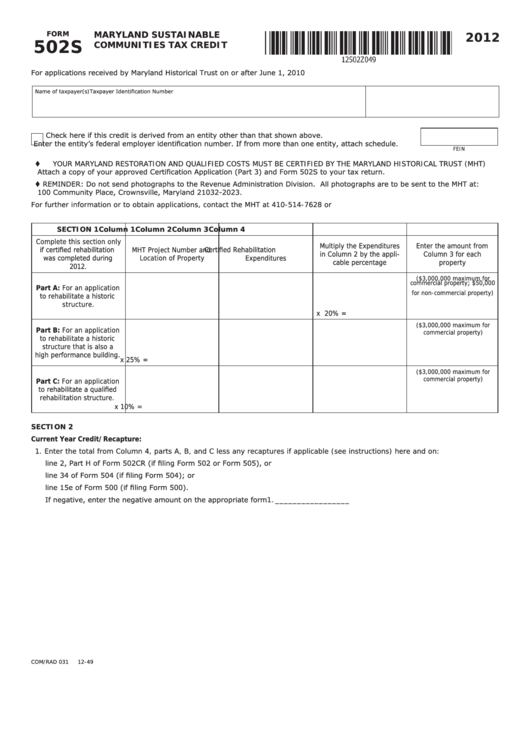

SECTION 1

Column 1

Column 2

Column 3

Column 4

Complete this section only

Multiply the Expenditures

Enter the amount from

if certified rehabilitation

MHT Project Number and

Certified Rehabilitation

in Column 2 by the appli-

Column 3 for each

was completed during

Location of Property

Expenditures

cable percentage

property

2012.

($3,000,000 maximum for

commercial property; $50,000

Part A: For an application

for non-commercial property)

to rehabilitate a historic

structure.

x 20% =

($3,000,000 maximum for

Part B: For an application

commercial property)

to rehabilitate a historic

structure that is also a

high performance building.

x 25% =

($3,000,000 maximum for

commercial property)

Part C: For an application

to rehabilitate a qualified

rehabilitation structure.

x 10% =

SECTION 2

Current Year Credit/Recapture:

1. Enter the total from Column 4, parts A, B, and C less any recaptures if applicable (see instructions) here and on:

line 2, Part H of Form 502CR (if filing Form 502 or Form 505), or

line 34 of Form 504 (if filing Form 504); or

line 15e of Form 500 (if filing Form 500).

If negative, enter the negative amount on the appropriate form . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1. _________________

COM/RAD 031

12-49

1

1 2

2